When we say time flies, it really does! We are already in Mid September; so far in this month there was only very few opportunities to capitalize in Stock market. Nifty is stagnating up and down; Sensex is following the same routine – From the perspective of Price action trading, we refer this as mean reversion market. Mean reversion technically refers to market structure in which markets might make extended moves but sooner or later prices would revert back to the mean. Market will be directionless (mean reversion) if multiple Big money players (like institutions FII, DII etc.) collide with each other for liquidity at same time. These environments give ample opportunity for range traders and option writers to make excellent returns.

Here are two stocks you should watch if you’re a fan of trading ranges.

Infosys – Combination of Random Price action and Volatility

Overall Market structure of Infosys is pretty random and non –directional, so far it’s underperforming its peers such as TCS, Wipro etc. and Price action clearly indicates the mean reversion context. Resignation of Vishal sikka caused sharp bearish impulsive move which made market sentiment even more pessimistic. Keep an eye on price action and developing market structure. Current context is an excellent opportunity for option writers.

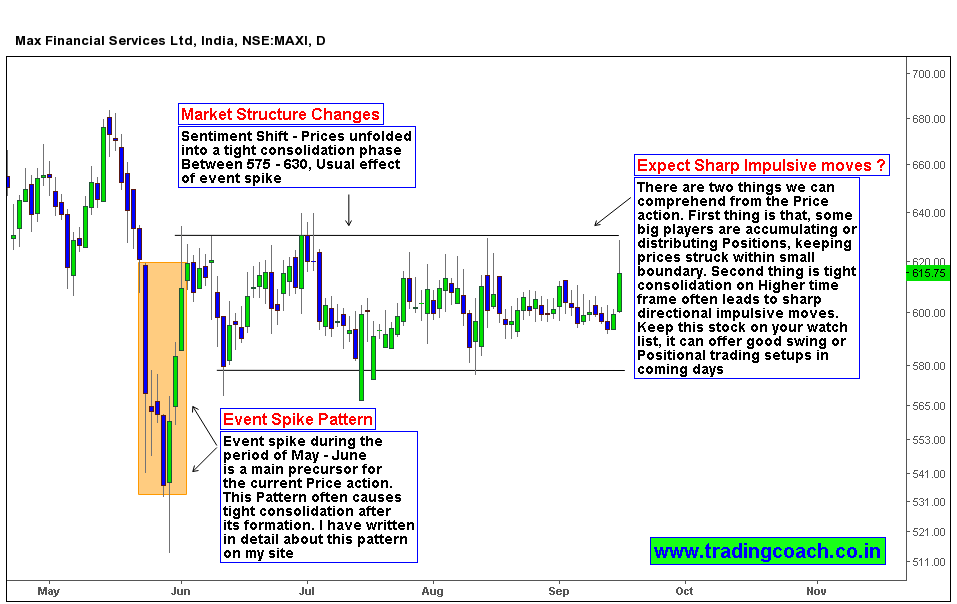

Max Financial Services – Tight Consolidation on the verge of Breakout

Stock prices are struck in a tight consolidation within 575 – 630 zones. Event Spike pattern in May is the reason for current Market structure. More often Event spike pattern causes tight consolidation, when it forms in higher time frame such as daily chart. (Read here to know more about Event spike pattern). Tight consolidation over long time leads to sharp impulsive movements on either side of the range. Chances of a sharp breakout combined with less liquidity can offer good swing trading or positional trading setups. Range traders must keep it in their watch list.

If you’re a specialist in range trading or an option writer, these two stocks must be in your market watch list. Monitor the developing price action and trade accordingly. Many traders do better in trending markets but most of them lag behind in ranging markets, if you want consistent results then its essential to focus your performance on ranging markets as well. We cover about range trading strategies and institutional trading methods in our premium course designed for Practical traders.