2016 is a significant year with a lot of Geopolitical changes. In my experience, trading 2016 was challenging and profitable. Ending the year on a Positive record is a pleasant feeling. Despite having a couple of losses, our books delivered good returns overall. Not all traders might had good experience and the same privilege, if you’re one of them – No worries, there is 2017 and It’s time to look at 2017 trading outlook.

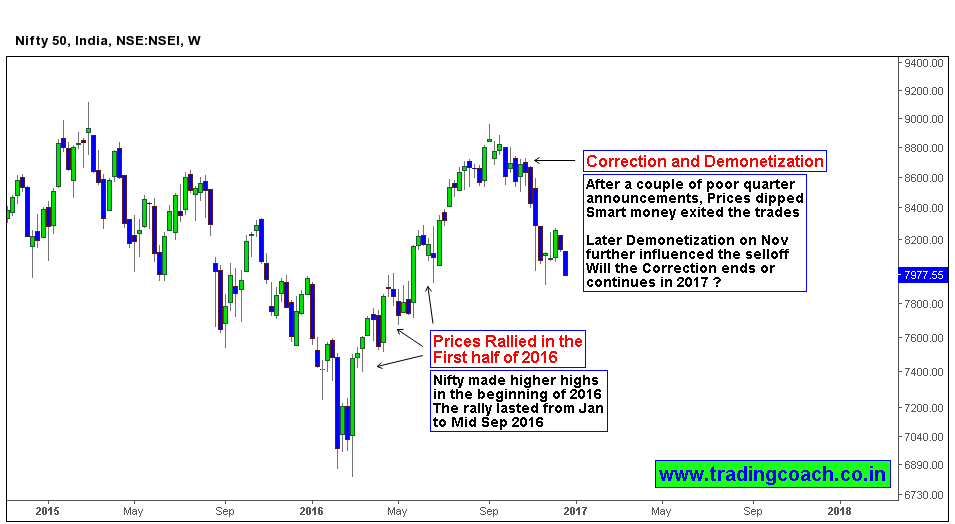

Nifty Awaits Demonetization Impact and Uncertainty in 2017

Nifty almost wiped out 4 month gains after Demonetization rolled in. Prices fell from 9000.00 till 8000.00, almost 1000 points wipe out. FII’s did a lot of selling in November and they remain skeptical. For 2017, the picture may become bit paradoxical. Many fundamental factors will influence the price action. But the most important ones are Demonetization impact and Expectations of 2017 budget. The big inflow of household savings into Capital markets is also a consideration to look after.

Though the short-term is bearish, Long term seems promising for Nifty. But that depends on government budget, policy schemes and global market sentiments. One thing is for sure, the present uncertainty will stay until the demonetization dust settles.

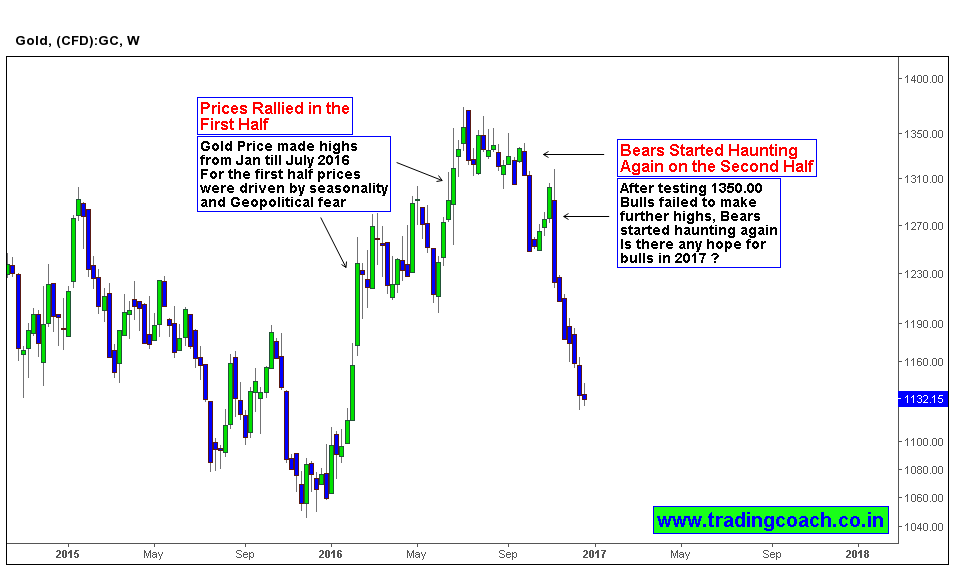

Bugs, Bears and Trump Will Take a Shot on Gold in 2017

Gold bugs, at first they predicted a rise in Gold prices (which never happened), later they said Trump’s victory as reason to buy gold (which again back fired). Instead markets moved opposite to their predictions. Why their predictions went wrong? Gold is a hedge for fear. Fears of inflation, war, calamity, instability are the prime mover of gold prices. Also Seasonality plays a crucial role. For example: From last 3 years, Gold always rose in the month of January and February because of Seasonal patterns. Gold is trading around $1135 per ounce.

Bears are still dominant in Gold; likely it will end the 2016 in a neutral sentiment. The price action in 2017 will be driven by Seasonality, Dollar’s strength, Trump’s presidency and Geopolitics. Prices might stay range bound or sell off in 2017. If we see a strong price rally supported by strong fundamentals in 2017 then sentiment will shift.

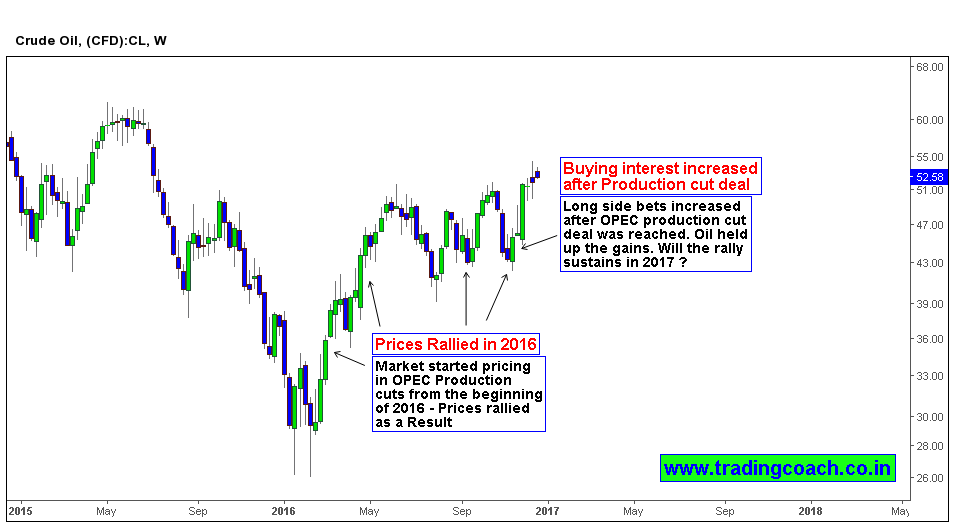

Crude Oil Boils Down to OPEC and Shale Producers – Demand can Change the Game in 2017

One of the biggest surprises in 2016 is crude oil. For the first time in 3 years, Crude oil ends with a positive tone. Price action closed higher on 8 out of 11 months this year. Obviously the reason behind rally is OPEC Production cut. Money managers loaded up on long side even before announcement became public. The sentiment turned bullish on Oil; but still there are many risk factors which can impact the sentiment. Some common risk factors include, US Shale producers increasing output rate and OPEC countries betraying the production cut agreement etc.

Targeting higher oil prices above $55 is self-defeating, why? US Shale producers will increase output and supply increases. For 2017, Oil is struck between Stability and Oversupply which may keep prices within range of 40-60$ per barrel. Only thing that can prompt a rally is higher demand from consumer countries like India and China. Traders must keep an eye on Supply – Demand forces to find potential opportunities.

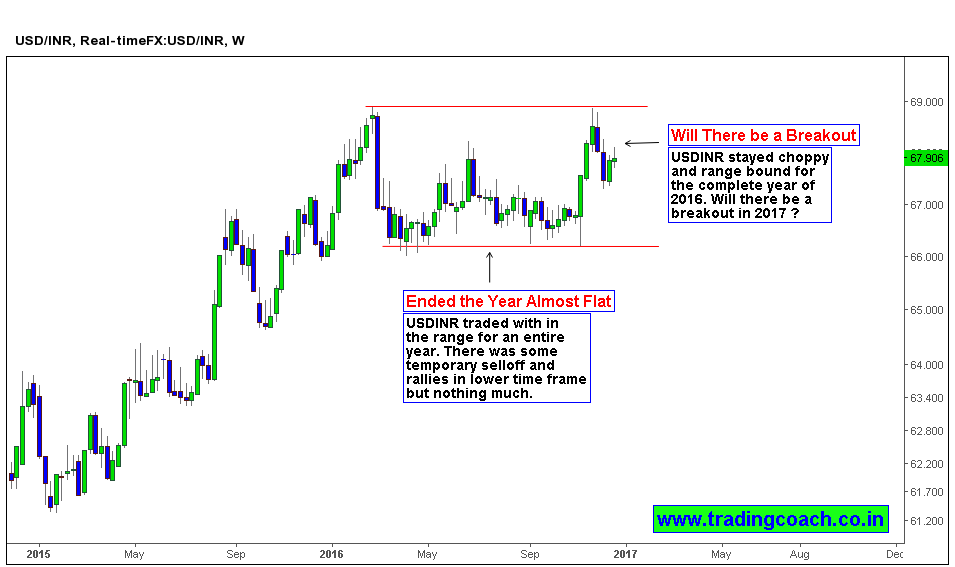

USDINR – RBI Intervention Will be a Reality if Dollar Tears the Roof

US Monetary policy normalization is a big theme for 2017. Currency markets are already pricing on more rate hikes and Investors are betting in further economic growth of US. Trump’s ambitious promises along with cyclical FED hikes can push USD further upside, but that also depends on how trump will shape his economic policies and how FED might respond to it. A strong dollar rally is a big risk for Global economy, it can cause balance sheet burden on Emerging markets. India is not immune to such risks, since demonetization is stealing the spot light; Domestic press is not giving enough attention to this financial trouble.

Current exchange rate of USDINR is 69.00, just a few points below the psychological level 70.00. RBI intervention will be a reality if dollar rallies massively in 2017. Expect RBI to step in and support the rupee if USDINR breaches above 70 – 72.00. Pay close attention on this one.

These are some key themes to watch for 2017, stay in tune with Price Action and Trade What You See. It’s better to use trading outlook as a map, Instead of treating it like a prediction