As we approach the beginning of November, Market volatility increases sharply before shutting down on December due to Market holidays. During this period traders can expect, High probability opportunities especially for swing trading and short-term trading. Successful trading is not just about finding proper entry or exit levels, it’s more than that. Time plays an important role in trading; In other words, Seasonality is very important factor to consider.

Based on Price Action Trading analysis, I have picked up 4 Stocks to watch out for coming weeks. These are not investing recommendations; instead I will watch these stocks, see their price action and scan for trading opportunities. These stocks will be in my radar as they have a tendency to offer high probability setups.

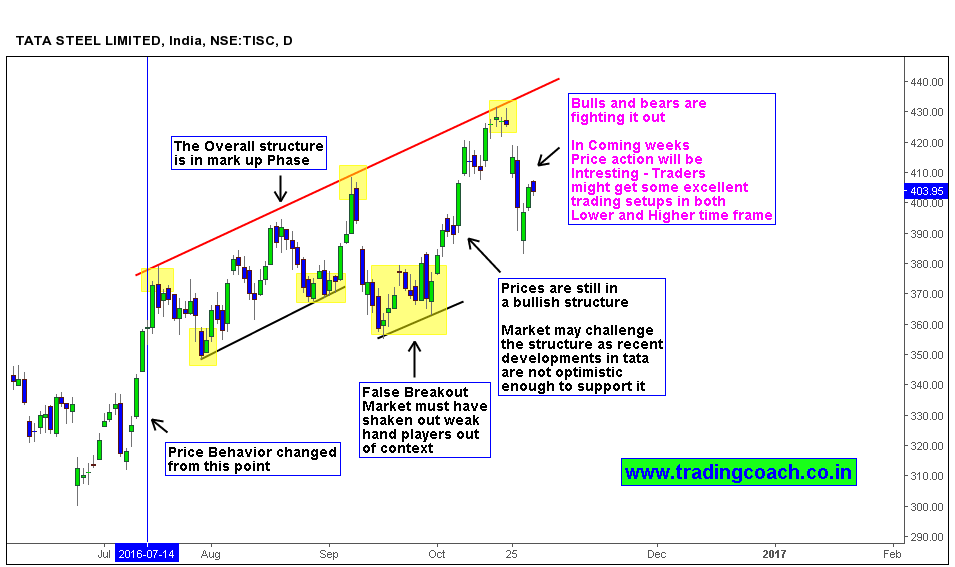

#1. Tata Steels | Share Price Action is Diverged From Fundamentals

Events happening with Tata Conglomerate are not optimistic news for share holders and investors. Tata Steels price action is struggling to push higher above 440.00 resistance zone. Though the overall market structure is bullish, Fundamental analysis doesn’t support it. Bulls and bears are fighting it out; it is better to wait for some clarity in price action before taking any directional trades. Traders can look for some decent trading setups on both higher and lower time frame in coming weeks.

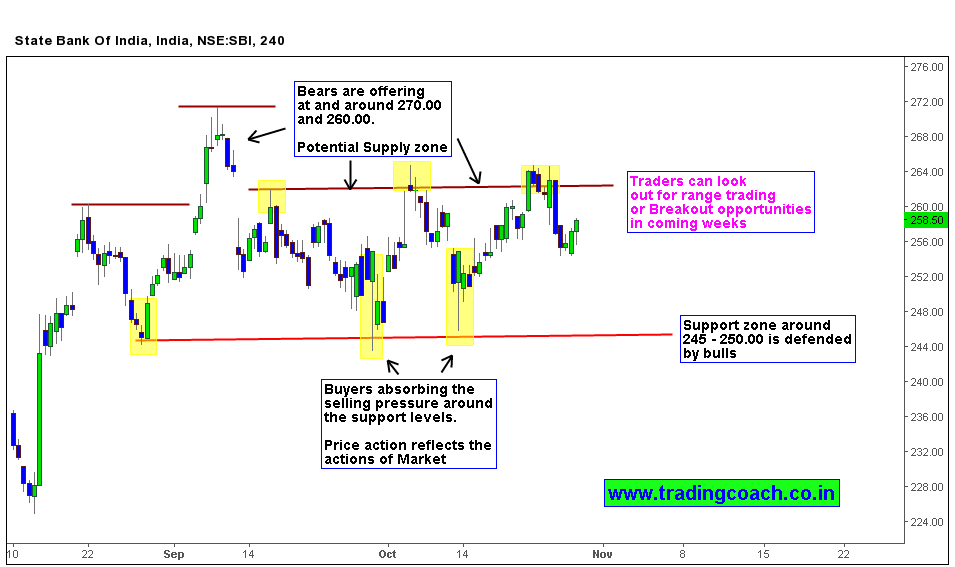

#2. SBI | Share Prices are Trading within Range

State Bank of India, the Indian Multinational public sector Bank rallied higher from March 2016. Long-term trend line providing support to the bulls. Currently the Price action is consolidating within the range, especially from September. Bears are selling around 260.00 – 270.00 resistance levels, which acts like a potential supply zone and Bulls are absorbing the selling pressure around 240.00 – 250.00 support levels. Traders can look for a potential range trading opportunities or wait for a breakout in coming weeks.

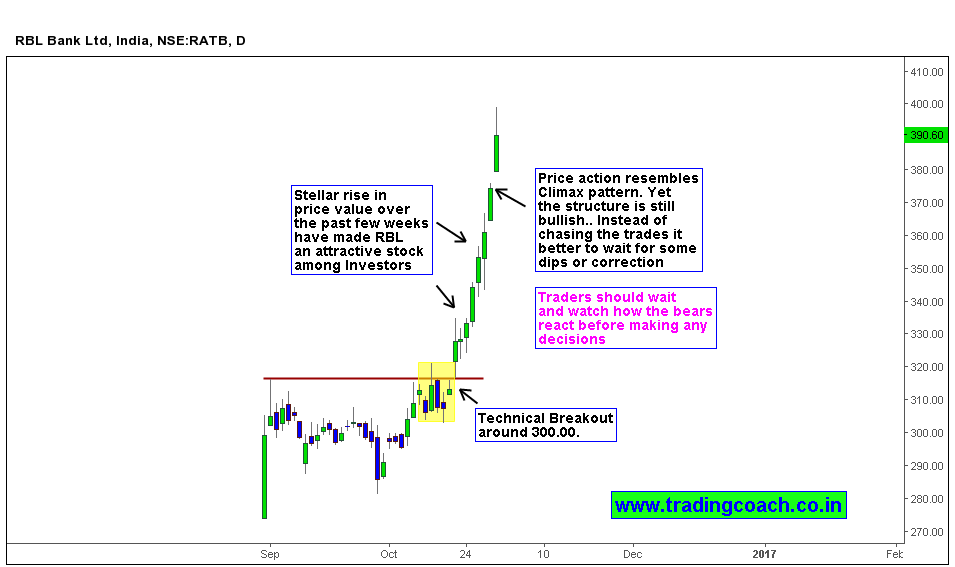

#3. RBL BANK | Share Price Action Shows the Possibility of A Correction

RBL Bank listed its shares on Aug 31 2016. The Share price value moved higher after a technical breakout at 300.00 in the beginning of October. Stellar rise in price value has made the stock attractive among stock investors. On the other hand the Price action resembles the climax pattern. Though the structure is bullish, we need to see how the bears react when buying pressure reaches its peak. Traders must wait and watch for any dips or correction, should analyze the resulting price action in coming weeks

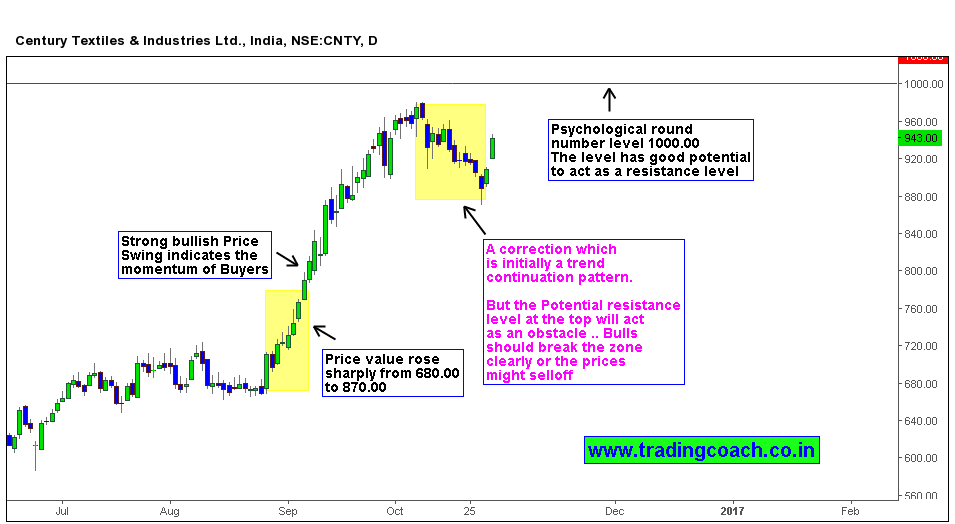

#4. Century Textiles and Industries | Potential Resistance zone at 1000.00 is in Focus

With Century Textiles and Industries, the market focus rests on round number psychological level 1000.00. As I mentioned several times in my previous articles, round numbers have supply – demand imbalance resting around them. During the period of September and till the beginning of October, the stock price value rose sharply from 680.00 to 870.00. Right now we can see that price action is in corrective phase. Though the structure is bullish, Price action should break the 1000.00 resistance level clearly for further continuation on upside. In case of any failures, market might selloff or turn into a range bound structure.

Just keep an eye on these Stocks for coming weeks, Analyze the resulting price action. Again these stocks have the tendency to offer high probabilitical trading setups, just by observing the developing market structure and Price action we can spot those opportunities. We cover more about Stock scanning and Stock trading strategies on our Premium course.