It’s clearly evident that markets are Bearish. Most of the Beta and Highly co-related stocks are witnessing extreme volatility and corrections.

But even in this bearish environment, Stock prices of Apar Industries have shot up by more than 57% in less than 2 months.

We had a minor Accumulation phase and the Breakout from that phase has pushed stock prices to new highs.

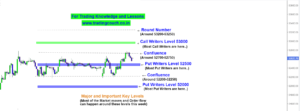

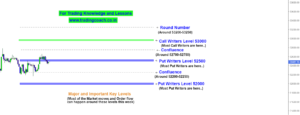

Take a look at the Price Action Analysis of the Stock on 1D Chart

Apar Industries – Price Action Outlook on Daily Timeframe

We can notice that Stock prices were trading in a range till the end of May. The Support zone was at 585 and the Resistance zone was at 700.

The signs of Accumulation were clearly observable within the range. It might be Insiders or Promoters buying the Stock in anticipation of something.

Right after the Breakout from the Accumulation phase, Momentum increased in stock prices and Buying Pressure picked up on the stock. Along with that, we also witnessed a drastic increase in the Volume.

By looking at the chart, we can understand that prices are transitioning from range to trend. If buying pressure sustains, we may see a new uptrend in Stock prices.

Given the present market conditions, it’s a good approach to keep an eye on the Stocks which are diverging from the broad market.

Keep the stock on your watch list, it might provide conservative trading opportunities in upcoming days.

Checkout the Video to learn more about the Analysis and Strategy