Rising dollar prices often brings a bad vibe among investors and traders; it’s because of the inverted co-relation between equities and the dollar.

I have already written an article about the negative co-relation between USDINR and Nifty 50. If you would like to learn more about market co-relations, make sure to check it out.

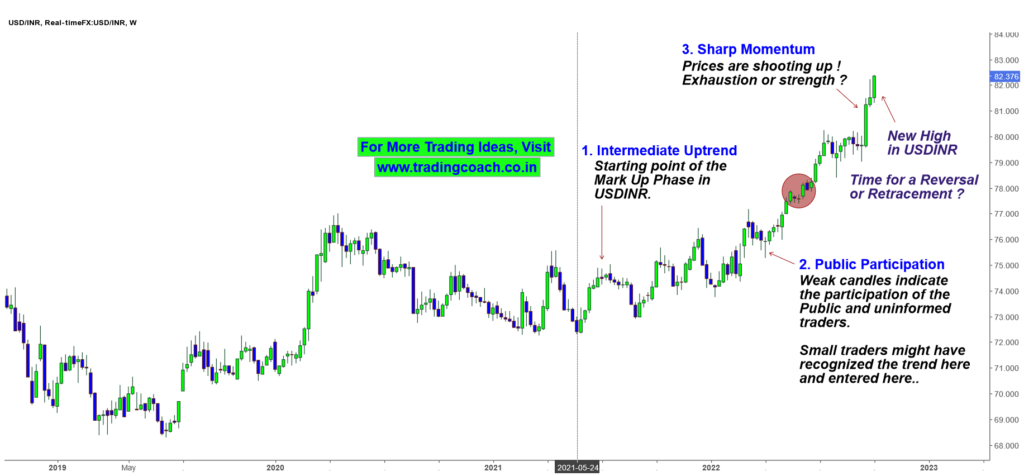

Right now, USDINR has made a new high. At the time of writing this content, it was trading somewhere around 82.25. This is not a good sign for stocks and the economy in general! Take a look at the Price Action outlook in a higher timeframe…

USDINR – Price Action Trading Analysis on 1W Timeframe

We can notice an excellent intermediate uptrend in USDINR which started somewhere during mid-2021. So far the trend looks strong and good.

Prices have rallied from 72.00 to 82.00 since the beginning of the trend. The uptrend in the USD coincided with FII outflows and FED rate hikes.

From the last 3 – 4 weeks, we can witness a sharp momentum in USDINR. Prices are shooting up either because of exhaustion or strength. Is it time for a reversal or retracement in currency prices?

In either case, traders and investors must keep an eye on the daily and weekly time frame of USDINR.

To learn more about the importance of Price Action in higher time frame, take a look at the video link given below.

Whatever happens with the USD can have a major impact on stocks and commodities. So it’s better to keep an eye on the chart!

So, what do you think about USDINR? Leave it in the comments below!