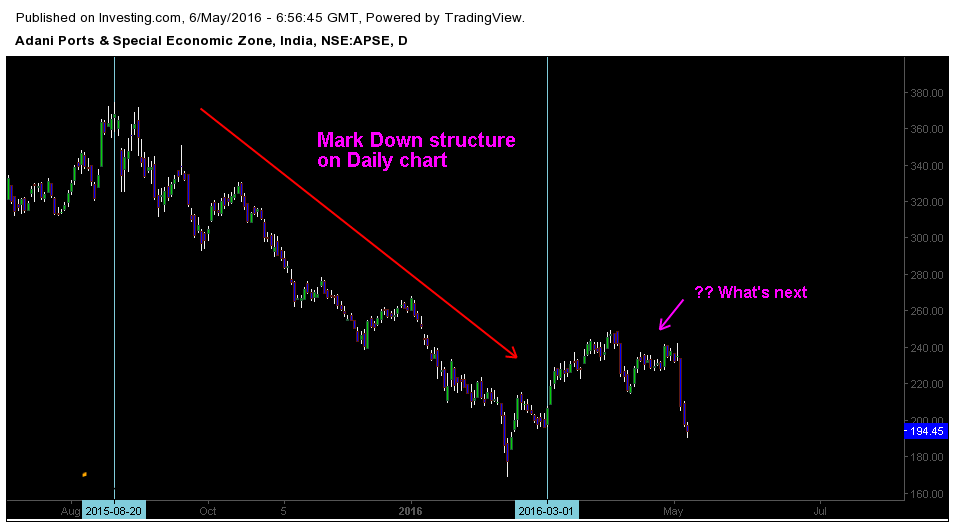

Adani Ports and Special economic zone slipped over 3 percent on Thursday. Lower than estimated results of quarter ended in March 2016 affected the price action. Readjustment of Profit estimation is influencing the investor sentiment. Volume readings are correlated with price action, confirming the thesis.

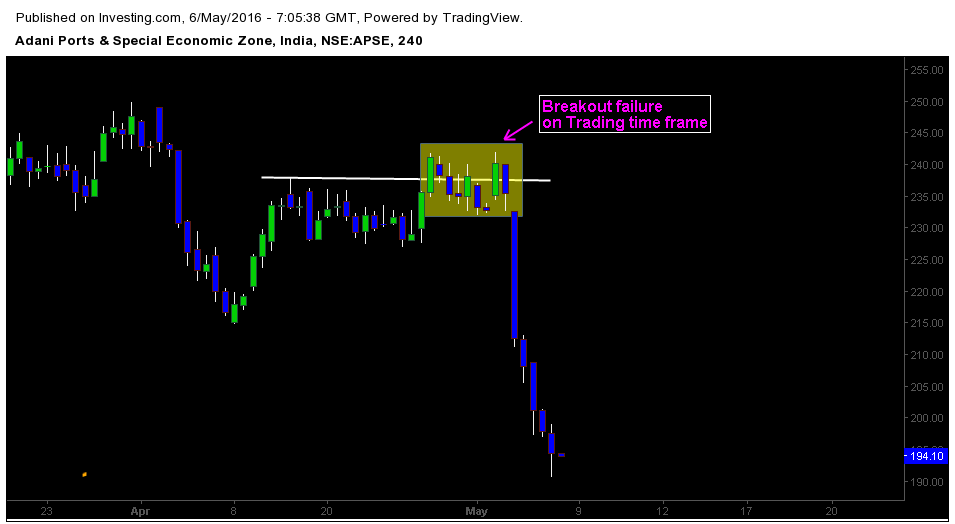

Below is the 4h chart of Adani Ports and Economic Zones with Price action analysis. Current Price Value is 194.50.

1. Key Support level was at 215.00.

Price action bounced off from the key level indicating the presence of buyers after first test. Later market broke the support level after readjustment of profit estimation. When we see the price action on higher time frame such as weekly or Daily chart market, Trend is still on the downside.

2. Tight consolidation near the resistance level 240.00.

Before moving into a massive selloff, APSE consolidated near the resistance area 240.00. The move has some liquidity significance due to many traders trapped by this consolidation. Price action perceived as Breakout on lower time frame turned into a failure.

3. Breakout Failure at Resistance level 240.00.

Price action formed a breakout failure pattern at 240.00 which indicated the failure of buyers to push above the resistance level. Failure of buying pressure combined with liquidation created an impulsive selloff.

4. Massive selloff correlated with volume readings.

Volume readings supported the impulsive bearish movement. Market took out the key support level at 215.00. Look at the chart for correlation between massive selloff and Volume reading. This confirms that liquidation and positioning has affected the price action, especially after readjusting profit estimates.

Traders should check price action for trading setups and opportunities. Look out for sentiment and fundamental factors which may influence price action. For a better trading edge and opportunity we should always combine fundamental analysis with Price action.