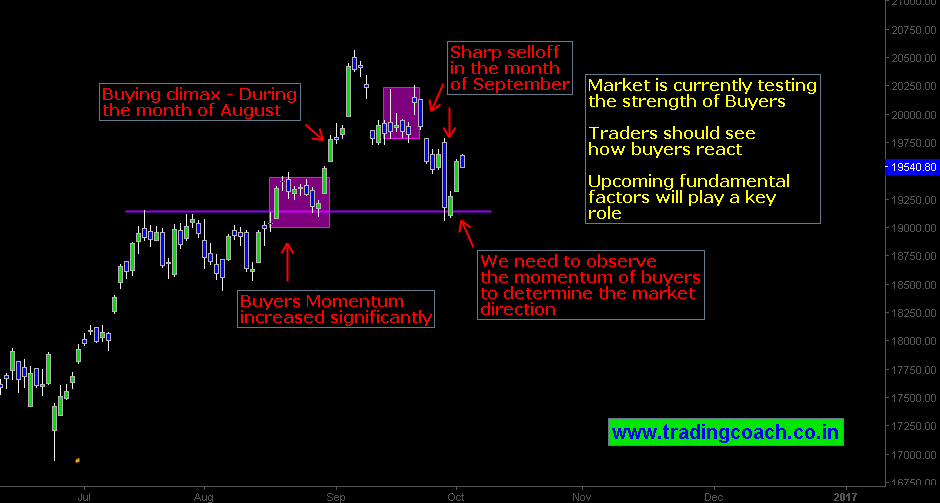

All eyes rest squarely on monetary policy of RBI and Political tensions over disputed border of Kashmir, Market participants are not clear what to expect from financial markets. While everyone is busy speculating about RBI rate cuts and its possible impact on Price action of Nifty and Bank Nifty, My focus is in the chart of Bank nifty – Currently trading near 20,000, notable psychological level for swing traders. Another important resistance level is 21,000 which was last year’s high. Bank nifty is at an inflection point, we can notice the change in trend’s character.

A Shift in Price Action Behavior of Bank Nifty

Upcoming Fundamentals will impact entire Market structure and pave the way for future market movements. Recent Price action of Bank Nifty is quite distinct from earlier retracements and corrections that occurred within the trend. September is a poor month for traders since many indices and stocks couldn’t breach beyond the tight consolidation. The tight consolidation is due to less participation and less liquidity. October seems interesting from the start as RBI policy and ongoing border disputes will entertain market participants. Investors should brace for more volatility in upcoming days.

Market shows a shift in the behavior of recent Uptrend’s structure. Sharp selloff from 20,500 to 19,000 on the month of September is indicating the strength of selling pressure. It obviously shows a shift trend’s character. We need to see how buyers will react, if influx of selling pressure relaxes. Traders should focus on Price action in daily chart.