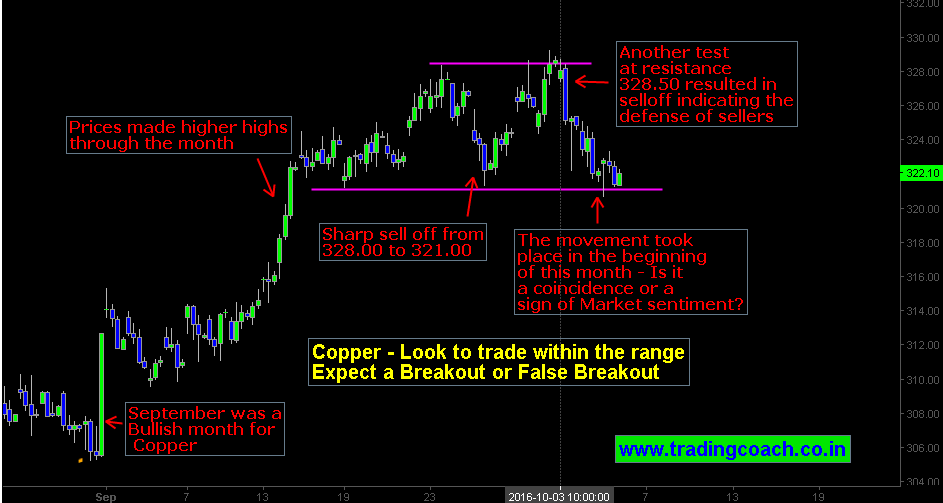

September was obviously a good month for Copper. The Industrial metal outperformed its counterpart commodities. Price action is driven by infrastructure requirements, especially the construction demands of china. China is a big motivator of Copper prices, the metal correlates with Chinese economy. From the perspective of MCX, copper trading around 329.15 to 321.00. There is no proper imbalance in prices; traders should wait for clear one mindedness of market sentiment.

Copper Price Action, Anticipating and Trading the Range

There’s no trading edge or positive expectancy in copper, since market prices are in long-term randomness. There are possibilities of few short-term trends spanning from weeks to months which might offer trading opportunities for traders. Currently trading within the range between 395.15 – 321.00, it’s a little hard to spot the signs of smart money players. Prices made higher high throughout the month of September, mostly because of Seasonality reasons. Sharp selloff from 328.00 to 321.00 during the last week of September marked the structural shift.

Another retest at resistance level 328.50 formed a price rejection, indicating the presence of sellers at resistance zone. Sellers defended the level aggressively twice. The level is harder to penetrate for bulls. Most interesting fact is to notice that Copper sold off sharply in the beginning of this month. There are two reasons for this; either it is due to Chinese national holiday, which is major market for copper or it is a sign of market sentiment for upcoming days. In both cases, it is necessary to observe price action. Traders should watch out for a breakout or False Breakout price action setup connected to big picture.