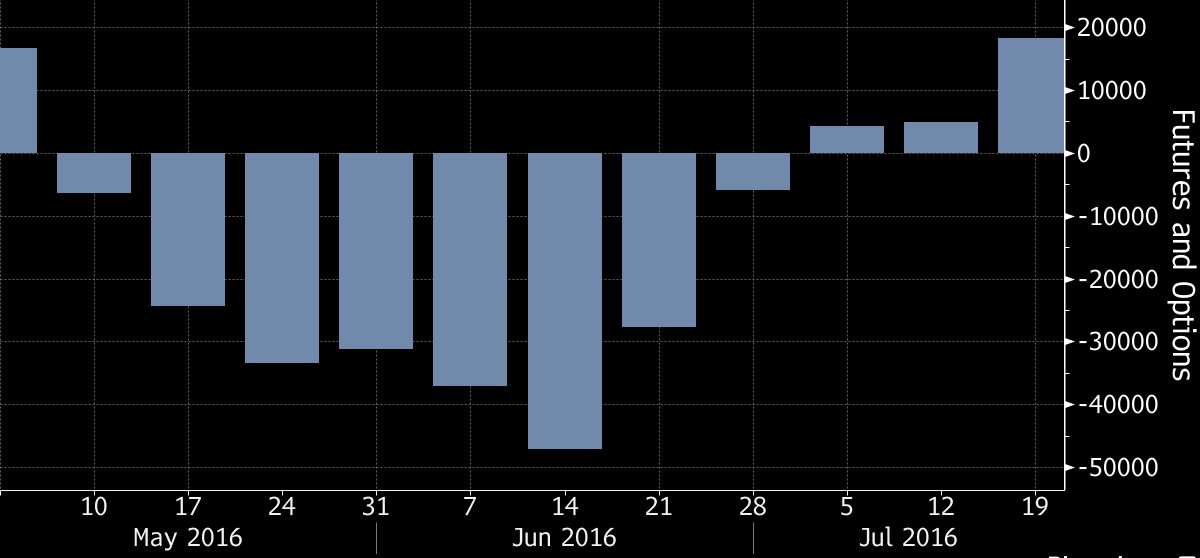

Hedge funds and other money managers have tripled their bets in Copper per CFTC reports. Price action made higher highs creating a technical markup phase which proves the validity of CFTC reports. Global economic outlook are way too diverged from Copper’s Market sentiment. Copper is an economic growth dependent metal – Instead of taking earlier geopolitical events as negative signs, Hedge funds and Money managers are jumping into the growth dependent copper.

Over the course of about 4 weeks, Geopolitical risks made stellar heights

1. Relationship between European Union and Britain has worsened aftermath Brexit referendum. Britain is desperately seeking for trade deals and diplomatic stability.

2. Failed Military coup in Turkey which is a plan to overthrow Turkish government.

3. Last but not least, Donald trump become the US presidential nominee of Republican Party, backed by establishment.

Instead of perceiving these as ominous signs, Money managers tripled bets on Copper. Historically copper was sensitive to these factors.

Is Market sentiment Shifting?

The optimistic outlook is driven by china, the world’s biggest consumer of copper. China’s copper imports reached an all time high in first half of the year, customs data showed last week. The country’s real estate sector grew faster than overall economy in the second quarter. Construction accounts for 30% of world’s copper demand.

There’s no enough supply to meet even a moderate demand. China is stock piling copper to meet supply deficit and feed into its real estate markets. The surge in net long positions is a turn round for investors, who were net short in the late June.

Technical analysis on MCX Copper for Price action trading

1. Adhering to CFTC reports, Prices made higher highs starting from June 17th.

2. Price action retested the once broken resistance level 317.00 and turned it into support. Traders refer to the action as price flips, to know more read my article about “price action flips”.

3. An up thrust at resistance 337.12, currently the pattern is intact. Traders should observe the resulting price action to decide whether the pattern fails or succeeds.

4. Copper is consolidating near the resistance level 337.12, after the up thrust pattern. Traders should observe the structure closely.

Copper was so beaten down; perhaps hedge funds would’ve looked at them as bargain hunting. Copper was a good entry point post Brexit and Chinese import data have compensated traders to take that risk. But all the news I have mentioned earlier is not optimistic for copper.

Global economic events and Price action are two sides of the same coin. Traders must keep intact with both of them to avoid getting blindsided by market forces. We need to watch Copper’s price action at resistance -support levels and keep an eye of Chinese economic reports.