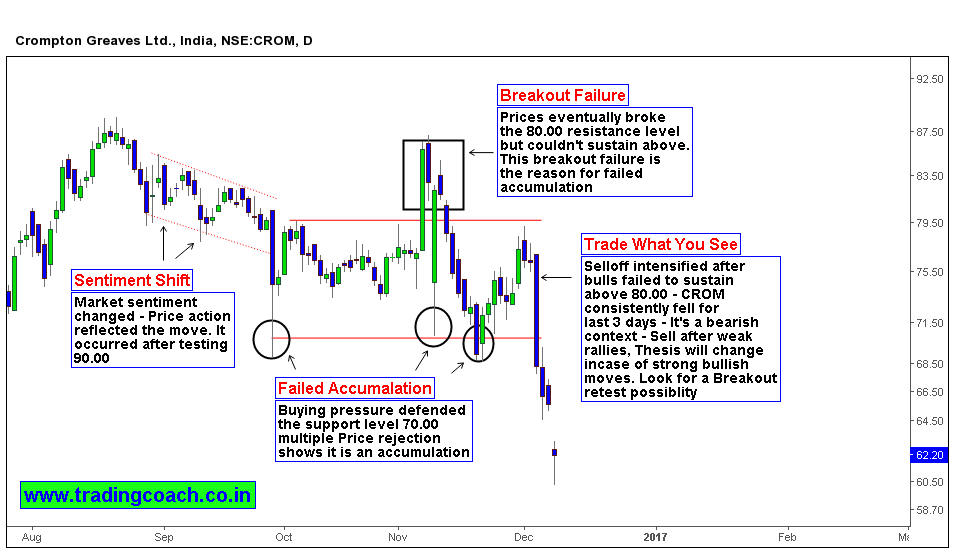

Crompton greaves (CROM) is trading lower from the beginning of December. Shares fell on the back of heavy volume. Negative sentiment is persisting since September 2016 (Look at my price action trading analysis on Daily chart) the recent selloff has intensified that negative sentiment. The restructuring balance sheet and debt reduction are main factors attributed to the sell off. The trading volumes on the counter jumped more than fourfold. Future direction of stock price depends on firm’s restructuring action and business growth value.

Prices locked in consolidation from October till end of November, oscillated back and forth trapping traders on both sides. December marked a shift in stock, as prices tumbled with heavy volumes. The preceding clue for the move was failed breakout in the beginning of November (see my chart analysis above for better understanding). It was an accumulation range, when bulls failed to sustain above 80.00 – the formation resulted in accumulation failure. We are in a bearish context due to this accumulation failure and we can look to capitalize on weak rallies and weakness in buying pressure. Possibility of a breakout retest remains. In case of any strong bullish moves, we need to reconsider the trading strategy.