Things change so do crude oil prices! Well when talking about crude oil prices many importing countries (including India) are living in a kind of invalid belief that “New Crude oil price forever”. Crude oil importing countries are not considering possibility of higher prices or at least consequences of rising crude oil prices – it’s a recipe for disaster. Well let’s see what happens in that case!! For now we will focus on Price action of crude oil.

In my earlier article I pointed out how prices diverged from usual cause-effect relationship with OPEC. Recent price action confirmed the thesis. Below is the 4h chart of crude oil with price action analysis.

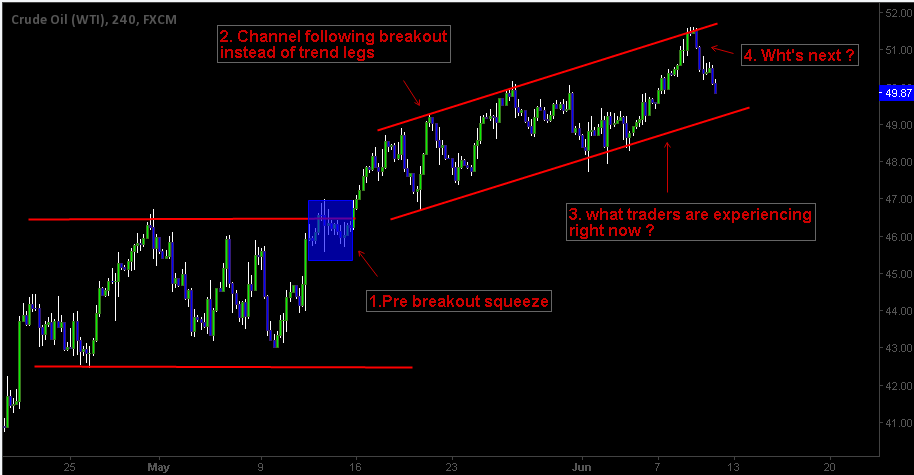

Crude oil price action analysis in 4h chart for trading time frame

1. Pre-Breakout formation or breakout squeeze as we call it – is a price action pattern which signals potential breakout. In this case, price action broke the resistance level at 47.00 and started trending upside. I pointed this as a markup structure in my previous article

2. One interesting aspect is that price action started trading like a channel formation following the breakout. Technically prices move into Impulse – Retracement – Impulse structure after the breakout but here we see a channel formation succeeding breakout. Does it mean that bulls and bears are involving in fierce battle?

3. It’s curious to see what traders are experiencing in this moment. Their feelings, mood, thoughts and sentiment can have interfered effect on crude oil. Currently the price action is influenced by sentiment and positioning factors not fundamentals. Market psychology will play a dominant role from now on..

4. What’s next? Technicals will drive the prices, so keep an eye on momentum and volatility behind price action. See how price trades within this channel, how it reacts at specific support and resistance levels. Also notice which news events are affecting crude oil. Monitoring these facts can help us to analyze whether bulls or bears are dominating the market and get trading setups for successful trades.