Over the week tables turned on the bulls, as crude oil started falling from beginning of the week. The optimistic spirit that gripped oil traders is dampening again. Though excess crude oil production is slowing down, Rising Inventories and revival in US drilling might increase the supply glut further. Technical analysis reveals that Oil fell from start of July. We can’t spot any convincing signs of Constructive demand.

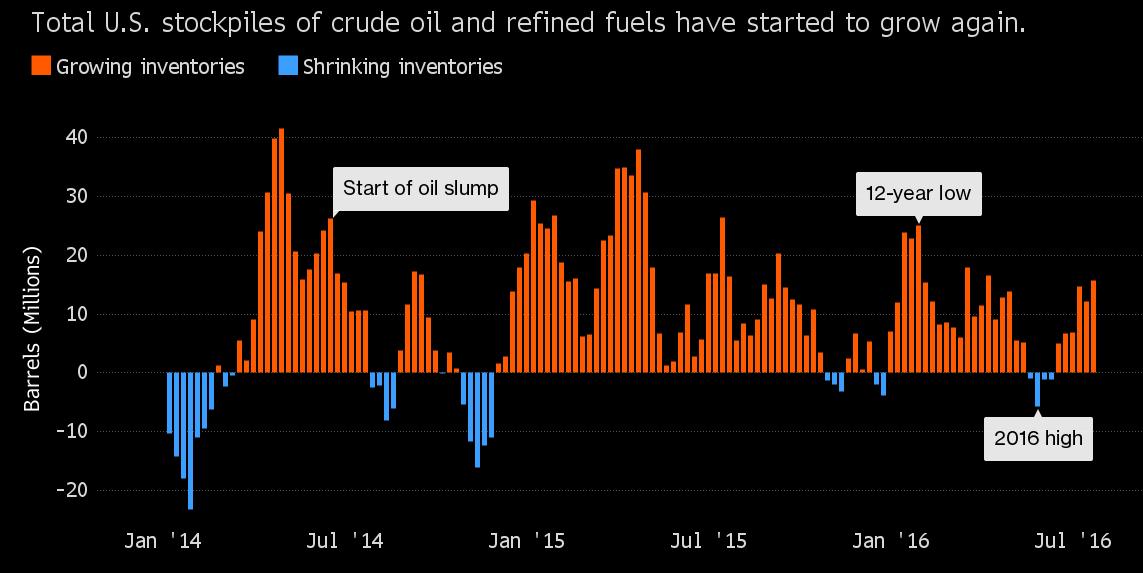

Oil Supply glut – Stock piles of US crude oil is growing again

In some countries the glut is getting bigger, as US government data on Wednesday showed a surprise increase in crude oil inventories. The summer seasons in United States drives the inventories lower historically but this time, it didn’t had any significant impact on crude oil inventories. It seems like the supply glut didn’t disappear but simply leveled off by disruptions in Nigeria and Canada.

We need to see glut reduction, in order for buying pressure to sustain in crude oil. The supply side should adjust sharply for that high demand from consumer countries such as China and India is necessary. The latest selloff might also show the strength of domestic bonds which curb investors appetite for Energies.

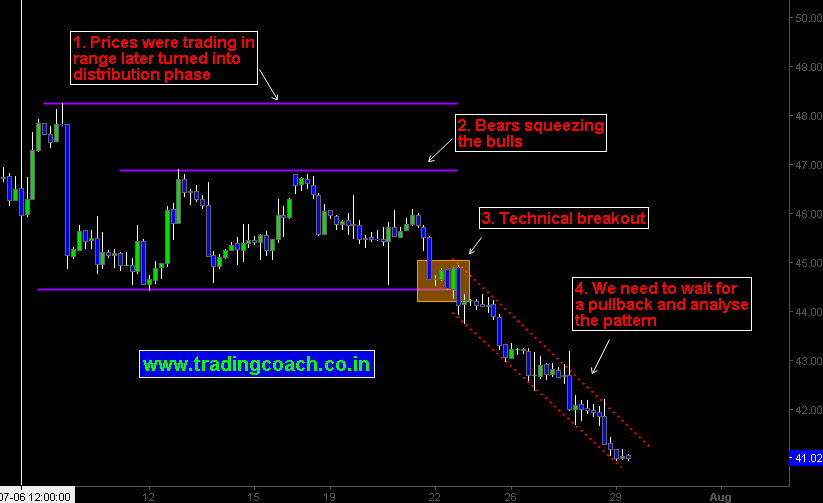

Technical analysis of Crude Oil for Price action trading

1. In the beginning of July, prices were trading in Range. I wrote about it several times on previous articles. The range later turned into distribution phase where smart-money players sold off their positions to average retail traders. Price action was defending the support level 44.45 mostly due to retail traders bidding at the zone.

2. Within the range, domination of bears was intact. Market prices squeezed the resistance down to 47.00 from 48.23

3. “Shadow lock pattern” at the end of previous week at support zone 44.50 which I‘ve highlighted on webinar formed the process of Breakout. We always treat these breakouts naturally with some skepticism. But in this case we can observe the momentum of selling pressure.

4. After such prolonged selloff or climatic impulse movements, it better to wait for retracements and analyze the price action instead of Jumping with the crowd. Even if we don’t get any pullbacks, it pays to wait on sidelines.

As a conclusion, for a change in Market sentiment we need to see a reduction in the Supply glut of crude oil. Also it is necessary for global demand to accelerate at faster pace than Supply side inconsistencies. Technically we need to wait and watch for price retracements or pullbacks to analyze the strength of buying and selling pressure before taking any trades.