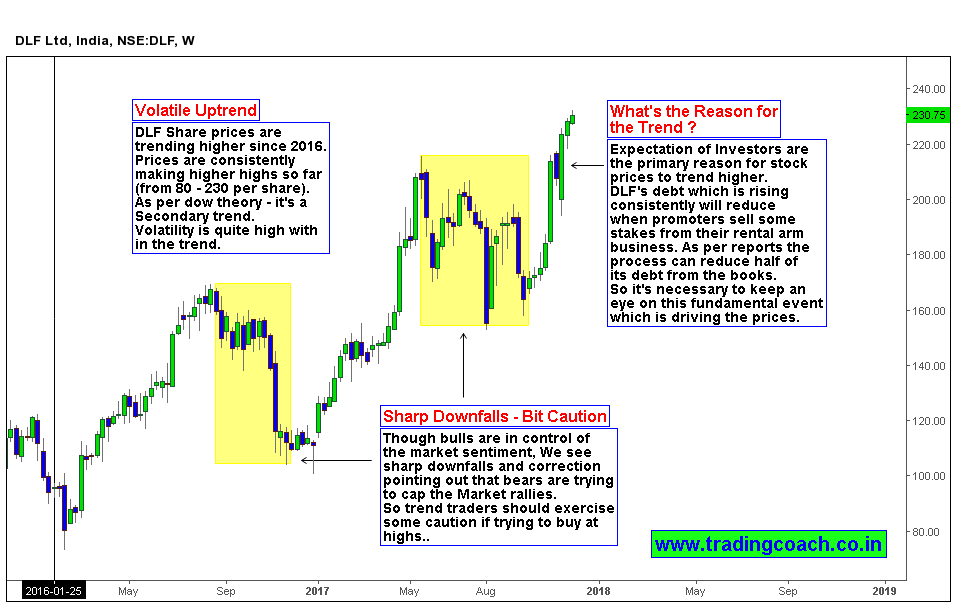

DLF is a name that some Stock Investors can’t forget! It’s noted widespread by many investors due to its lackluster performance before 2008 Market crash and Worst performance post market crash. Share prices are trending higher since 2016; Market prices are consistently making higher highs, so far shares have rallied from 80 to 230 in a span of less than two years. The Uptrend is clearly visible on Weekly chart and it’s a secondary price trend as per Dow Theory.

DLF Shares | Price action shows Volatile Uptrend in Weekly Chart

The volatility is very high in the trend structure but still directional swings provided multiple opportunities for trend traders to position themselves within the trend on lower time frame.

Though the bulls are in control of Market sentiment, we can witness sharp downfalls and corrections within the trend (along with high volatility), indicating that bears tried twice to stop further advances of the trend. Short sellers always preferred stocks like DLF and that’s for a specific reason – Underperformance! Many investors bought DLF at the Peak of 2007 for insanely overvalued price of 900 -1000!! Fast forward 10 yrs to 2017, still the share prices are below its IPO value of 500. No wonder why bearish bias keeps haunting DLF when share value makes a high…

So what about the current price trend that we’re seeing in DLF? What’s driving the trend? It’s the expectation of Investors and that’s the primary reason DLF rallied from 80 – 230 in a span of less than two years! Fundamentally not much has changed with the company, the balance sheet shows that it’s still in debt and has many unsold projects. But the talks on Debt restructuring (the process is going on for 2 – 3 years) and their recent plan to sell some promoter stakes in rental arm business to cut the debt or At least to move the debt from their books has spurred a positive bias among Investors. As usual Market is pricing in the expectations that things will be well for DLF in future. Whether the management plans work out or not is something that we need to wait and watch! Keep an eye on this fundamental event that’s driving the prices and take decisions accordingly.