Gold broke out of resistance zone $1338 – $1334 after Federal Reserve left interest rates unchanged, though the FED hinted at the possibilities of rate hike in coming months. Comex gold for December delivery was recently up 0.9%. Price action spiked after FED eased the expectations of Rate hike. As I pointed out several times in my previous articles – Gold is sensitive to raising US rates and global economic outlook. Many analysts are pointing out the fact; FED is unlikely to raise interest rates due to upcoming US presidential elections.

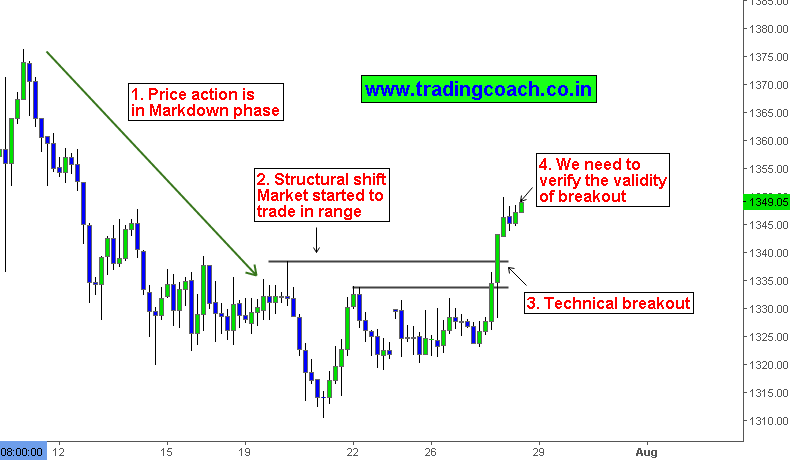

Technical analysis of Gold in 4h chart for Price action trading

1. Price was in mark down phase from 11th July. Economic reports pointing out resilient growth and post Brexit correction created a short-term liquidation selloff. Gold fell from $1376.41 to $1310.48.

2. Market bounced back from low $1310.48 resulting in Pullback failure. Gold created a structural shift, price action started trading in a range bound structure $1310.48 – $1338.71

3. After FED statement, Gold spiked above the resistance zone $1338 – $1334 forming a technical breakout pattern.

4. We need to verify the breakout to confirm the strength of buying pressure. Price action may retest the previous resistance zone $1338 – $1334. Buyers should defend the zone to prove their domination.

Traders should observe the buying pressure and price action at key levels. Also keep an eye on some fundamental analysis such as movements of US dollar, US economic reports and domestic economic status. It is better to trade along with the dominant price structure.