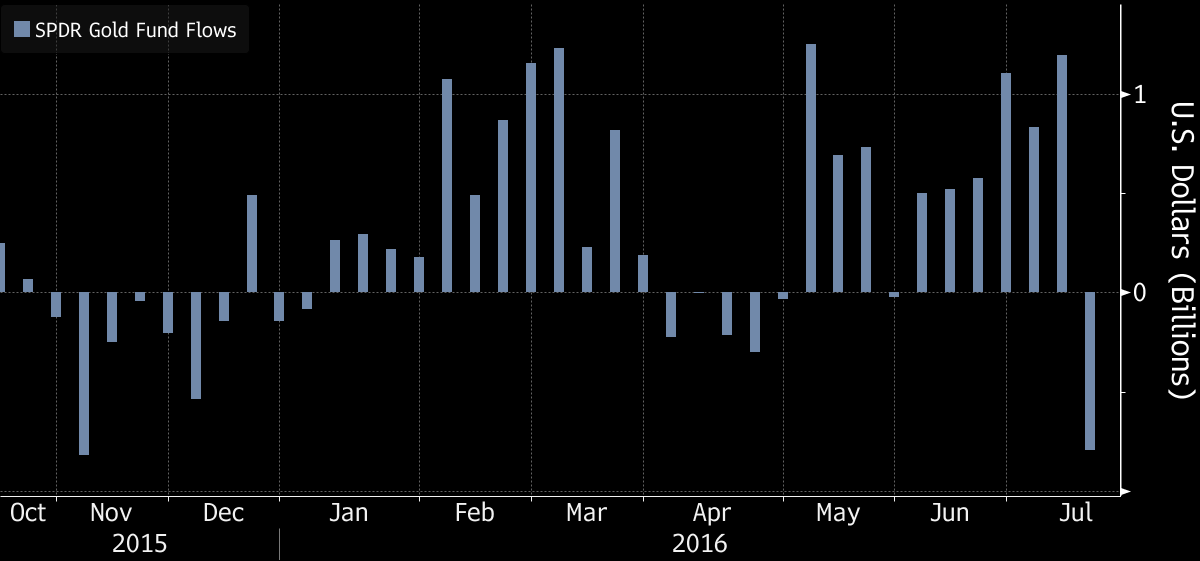

Improving economic outlook and global conditions are reducing the demand of precious metal. Investors pulled $793 million last week from SPDR gold shares – An exchange traded fund backed by gold. Holdings in world’s gold backed ETF slipped 3.9 metric tons last week. Prices are now trading in tight compressive range on lower time frame around $1332.

FED rate hike expectations climbed after US economic reports on Friday showed gains in consumer prices and retail sales. Speculators are currently focusing on central bank policies to take bets in global markets. The fund flow out of gold is mainly due to these reasons. Investors may again reassess outlook if they see improvement in global economic conditions.

2h chart of Gold for price action trading

1. Gold fell from $1375 to $1320 an ounce in MCX and International spot markets. The move lasted from July 11th to 14th. Price action took support at 1320.50 following other precious metals.

2. Structural failure to make further lows caused prices to shift sideways. Market behavior reverted to ranging price action. Structural resistance is at 1336.10.

3. We notice small candlesticks within the range bound structure. Price action traders refer to this pattern as compressed range. Weak hand players are trapped on both sides due to low liquidity.

Market direction of Gold Prices depends on geopolitical concerns and safe haven demands. As mentioned in my previous gold technical analysis updates anything good is bad for gold. Traders should focus on support and resistance levels to find trading setups. Also keep intact with US economic reports and geopolitical conditions.