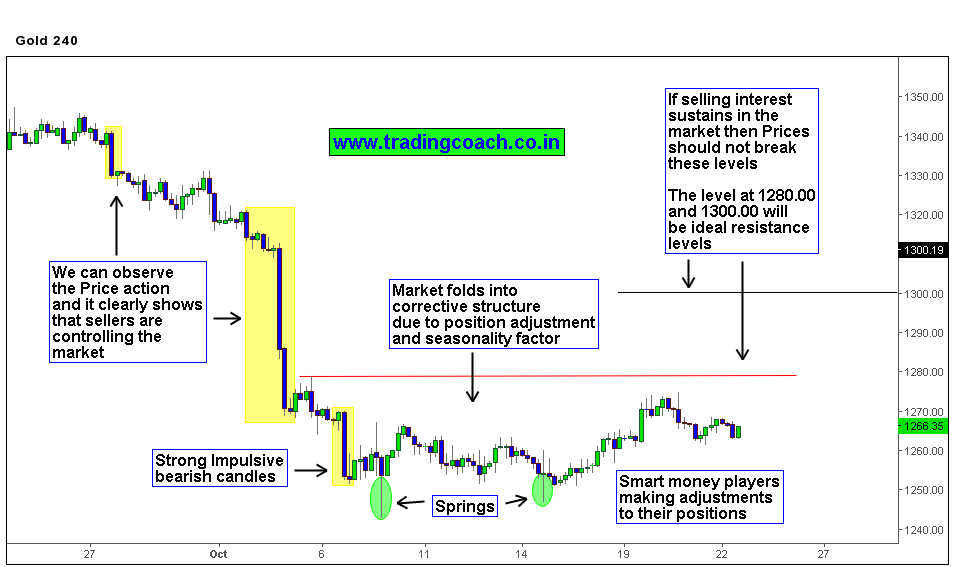

The precious metal Gold is disappointing the Gold Bugs as well as traders like you and me. Looking at the 4hr chart of Comex gold (The analysis is also applicable for MCX Gold Trading), we see the bears persisting and absence of bulls. Will the situation change as we move towards Diwali demand? Or is the gold weak; is it weaker to the extent that even Strong seasonal demand couldn’t lift prices higher? The questions will remain unanswered unless we see a strong impulsive movement on either side.

Market structure in 4 hr chart is clear, Gold is in Corrective phase – Strong bearish candles and bearish impulsive movements caused by influx of excess selling pressure pushed the metal into corrective phase. The tight consolidate price action is reigning since the beginning the October. Apart from the springs – A classic Wyckoff Pattern, I couldn’t spot any sign of bulls. The springs may represent smart money players who are adjusting their previously held bearish positions, so we can’t bet just by one indication.

If the sellers sustain in the market then price levels at 1300.00, 1280.00 will act at as resistance zones, and market may not be able to break these if there is strong selling interest. Any strong impulsive bullish movements should be treated with caution, and it might be necessary to change the trading idea.