Gold prices are fluctuating between gains and losses, uncertainty taking its toll on the precious metal. Long term price action shows the picture clearly. Investors are confused whether to add the metal to their portfolios or just to neglect it. Speculators are begging the question whether is it a bottom or not? Market Participants are hesitating to make a financial decision. According to some traders, Daily buyers (Pit traders and Market makers) are buying on the dips whereas long-term investors are still nervous about Gold. It is obvious to note that Gold prices are struck in a range and fundamental factors from US and FED is driving the Price action.

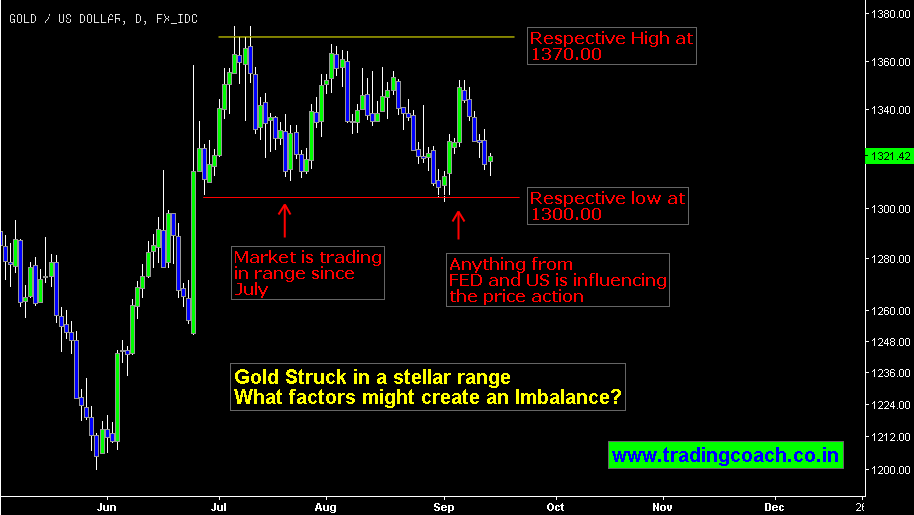

Gold Price Action Trading in a Range – What Factors Might Create a Trend?

Technically, Gold is trading in a range between 1370.00 – 1300.00. Structural highs and lows formed exactly around the same spots. We can see two-way business in gold as buyers arresting the price declines and sellers offering at the rallies. Volatility is average yet movements are paradoxical enough to make sense. One important thing is to understand the relationship between US Dollar Index (DXY), US Economic status and FED’s implications on Interest rates.

Gold prices have fallen over last week due to comments from FED officials (mostly hawkish) sparking Investor concerns. But in the beginning of September, Dovish comments and some negative US economic reports pushed gold prices higher. US dollar on the other hand is becoming less sensitive to FED and economic reports but price movements of US dollar index are inversely affecting gold. We still have no idea what’s driving the US Dollar Index but Gold is driven by Dollar movements. Intermarket relationship is bit difficult to interpret this time. From the above facts we can conclude that FED Monetary policy and US Elections (implying the effects on US Economy) will be the next big drivers that can create a trend in Gold Prices. The Next Fed policy scheduled on Sept 20; it will be closely monitored by market participants.