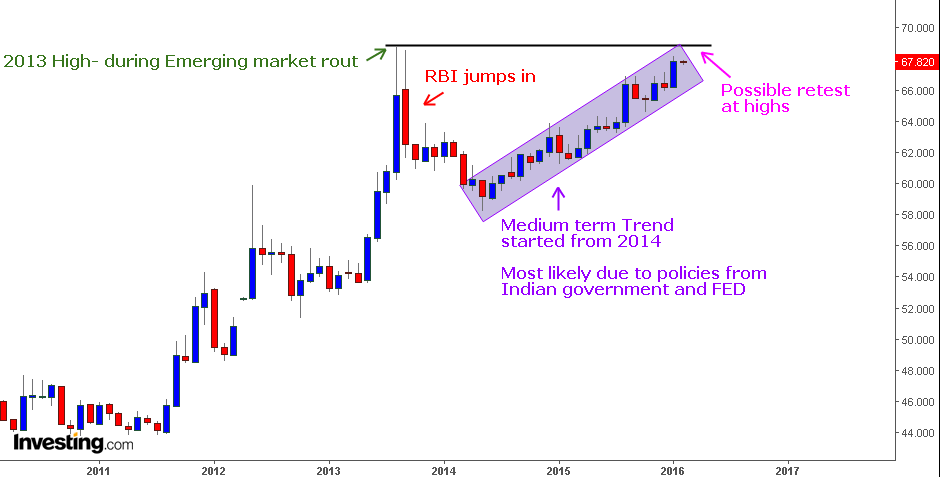

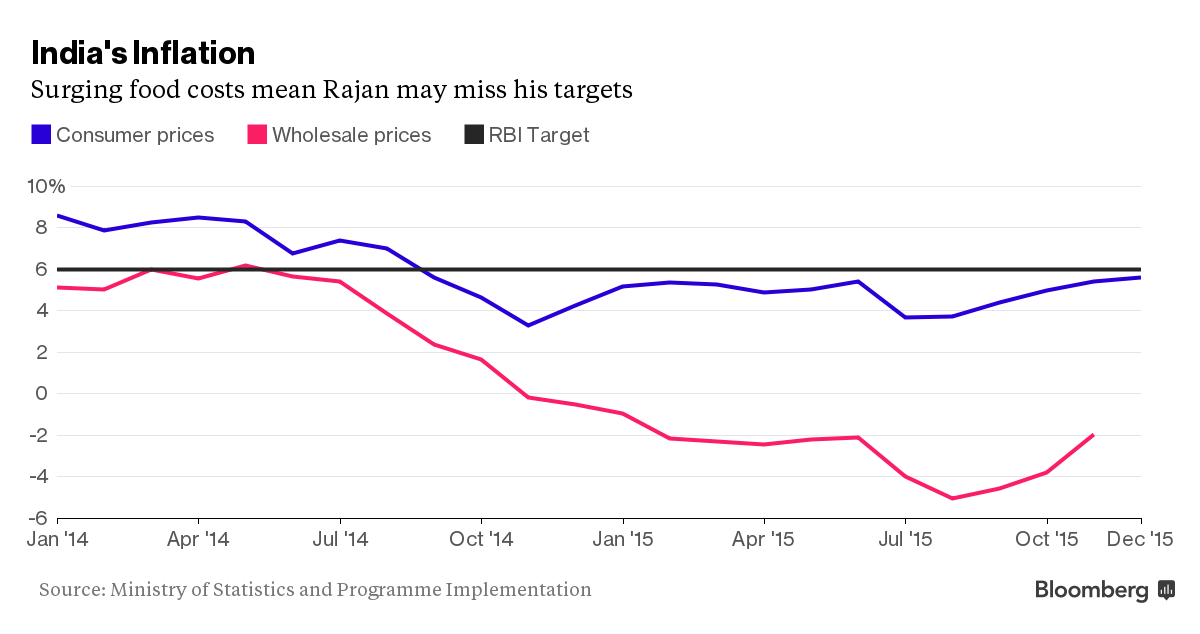

The slumping price of USD/INR and an expansive budget will probably prevent Indian central bank Governor Raghuram Rajan from cutting interest rates on Tuesday. Rupee’s 2.3 percent loss this year, risks worsening inflation if Prime Minister Narendra Modi cuts stimulus spending rather than subsidies. The fiscal and inflation risks could feed into and worsen the rupee’s plunge. Investors, who’re already cutting holdings of emerging-market assets amid the China-led turmoil, may flee India if policy makers fail to meet their targets.

Thirty-six of 38 economists in Bloomberg survey predict the Reserve Bank of India will leave the repurchase rate at 6.75 percent, while two see a cut to 6.5 percent It’s most likely the case that RBI will focus on central government’s fiscal policies and consolidations. As per lessons in economics, expansive fiscal policy and monetary policy results in inflation. Rupee’s fall adds further concerns from this perspective. Read here about Monetary policy..

USD/INR, Inflation and Deficit Risk

The rupee’s slump is a challenge to the central bank’s credibility as it strives to slow inflation to its 5 percent target by March 2017. An expected increase in government salaries and military pensions risks stoking demand further. Swaps are pricing in the possibility of a half-point reduction. Wondering how USD/INR and Nifty is connected? Read here

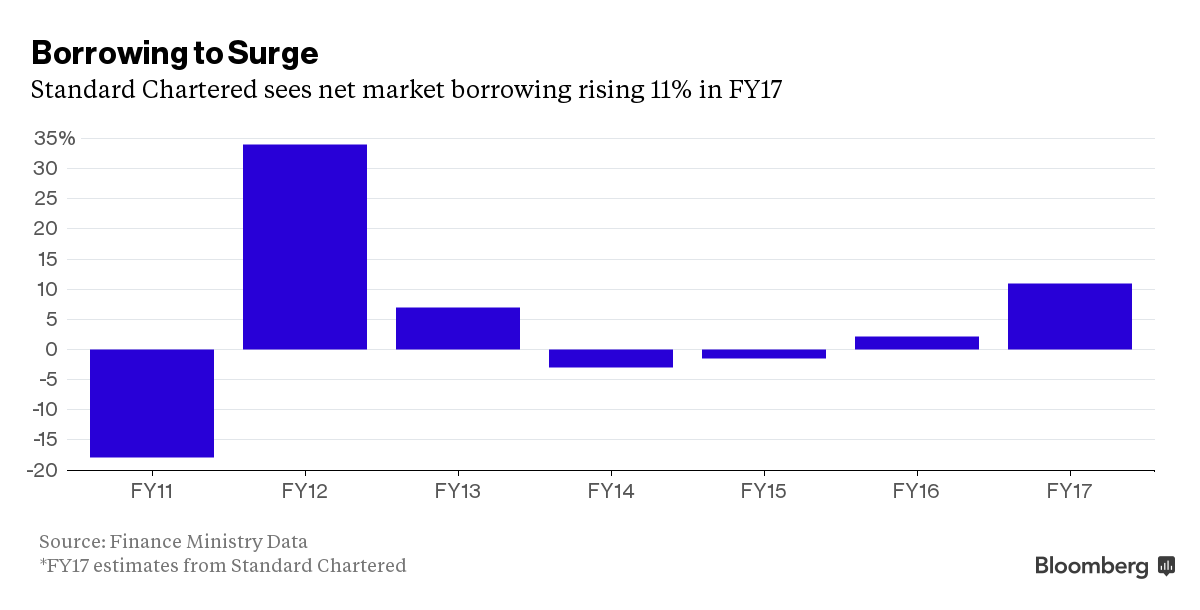

A larger deficit would force Modi to borrow more, giving Rajan leverage to press for fiscal discipline in return for keeping benchmark rates low. Since the government meets about 85 percent of its deficit funding needs from the market, yields will stay raised if the supply of bonds outstrips demand.

Rajan on Friday warned the government against boosting growth by borrowing more from the markets. “Deviating from the fiscal consolidation path could push up government bond yields, both because of the greater volume of bonds to be financed and because of the potential loss of government credibility on future consolidation.

A nice article on Bloomberg – Read here..

2 thoughts on “How USD/INR might Influence upcoming RBI’s decision”

Hi Mr Balaji,

Is this fundamental analysis important to forecast the USD/INR ? Do we really have to care about those kind of informations ?

Sincerly

Yes Younes, it’s essential to understand the large scale pictures and stories