Indian Oil Corporation stock prices react to the catalytic announcement made by the company. Indian oil corp. will spend about 400 billion rupees or $6 billion dollars to boost capacity by 30% for next six years. The move was planned due to booming fuel demand and expansion comes as Indian refiners are racing to add capacity amid rising consumption. International energy agency estimates that India will surpass Japan as the world’s largest third oil user and fastest growing crude consumer through 2040.

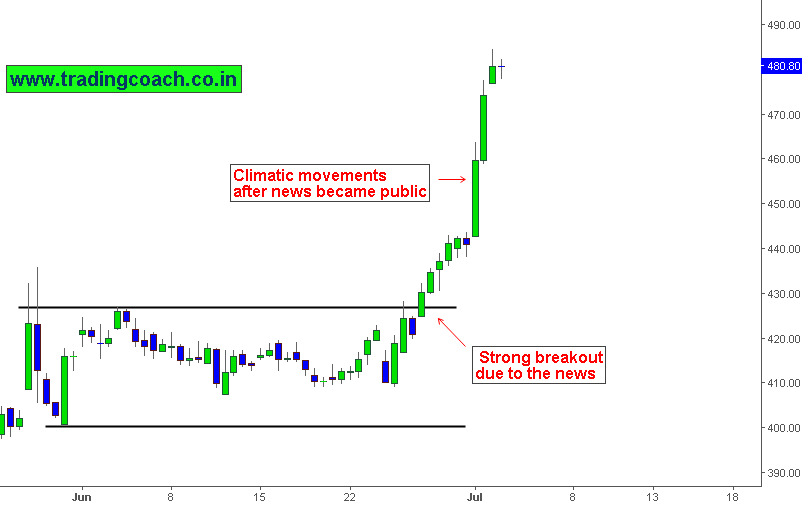

Price action broke out the stimulative resistance at 425.00 preceding the announcement shows feeding frenzy of investors buying pressure. When the announcement becomes public, strong impulsive movement turned into climatic gains.

Indian Oil corporation share prices for price action trading

1. The state-run company aims to increase its capacity to about 104 million metric tons a year or about 2 million barrels per day, during the next years by expanding the refineries across the country

2. Indian Oil Corporation currently process 80.7 million tons of crude a year from nine plants including two plants owned by its unit Chennai petroleum corp.

3. Indian Oil now accounts for 35% of nation’s total production.

4. Separately Indian oil is working with government as well as other refiners to build a 60 million ton per year producing refinery on the west coast.

The plan or strategy comes after the forecast by IEA on India’s oil demand to reach 329 million tons by 2030. Investors and traders should keep an eye on Indian Oil Corporation for potential opportunities in coming days.