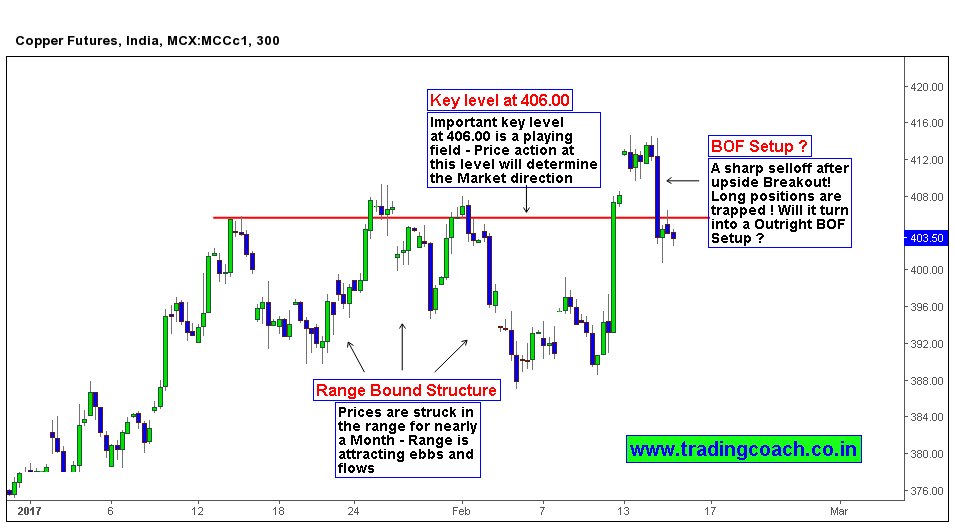

MCX Copper trading at 403.00, slightly below an important resistance level 406.00. By examining the charts, we could see that Market was struck in a range for nearly a month. It seems like an effect of stellar rally in November and December, from that we can conclude it’s like an intermediate correction taking place in Copper. When we look at the weekly timeframe, we can get the picture straight forward.

Around 10th February, Copper broke the long standing resistance level 406.00, but momentum couldn’t sustain and prices rejected back sharply on Feb 14th. Now it’s technically a BOF Setup – At least for Short term trading. (Also keep in mind that copper in Weekly chart looks bullish) Given that it’s a Bearish setup and range trading opportunity, it only makes sense to enter with Good Risk: Reward. (Considering strict stop-loss and clear entry)

As a Price action trader, I am not concerned about predicting the Market prices! For me it’s all about getting right trades with good risk: reward. I care more on the process and consistency than immediate results, so this trade is in my box and I will watch it constantly. Incase if long-term bullishness re affirms, I may change the plan and exit the trade.