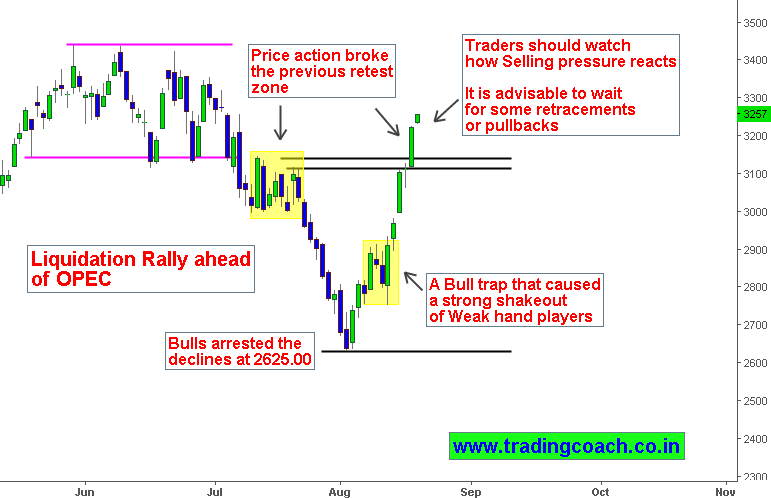

MCX Crude Oil prices rose 3.1% and currently trading around 3650.00. Price action is just slightly below the previous month’s high 3300.00 might possibly test the key level. Oil has risen 20% from a low in early august ahead of OPEC Announcements. Market sentiment is once again driven by geopolitics and news events from OPEC. The recent move is a liquidation rally ahead of upcoming external uncertainties. There are some rumors behind the scenes that world’s biggest oil producers might push forward for a production freeze which can restrict supply forces.

Crude Oil Rallied due to position covering ahead of OPEC

After bulls arrested the declines at 2625.00, Oil prices bounced sharply from the key level. Like I pointed in previous article, Market structure formed a bull trap pattern which resulted in shakeout of weak hand players added further momentum to the rally. Initially Price action was driven by short covering as hedge funds and other money managers cleared some of their holdings in crude oil. Market broke the previous retest zone 3100.00 which was also a key resistance level. Though buying pressure is dominating the current structure, Traders should look for retracements or pullbacks to asses the momentum behind selling pressure.

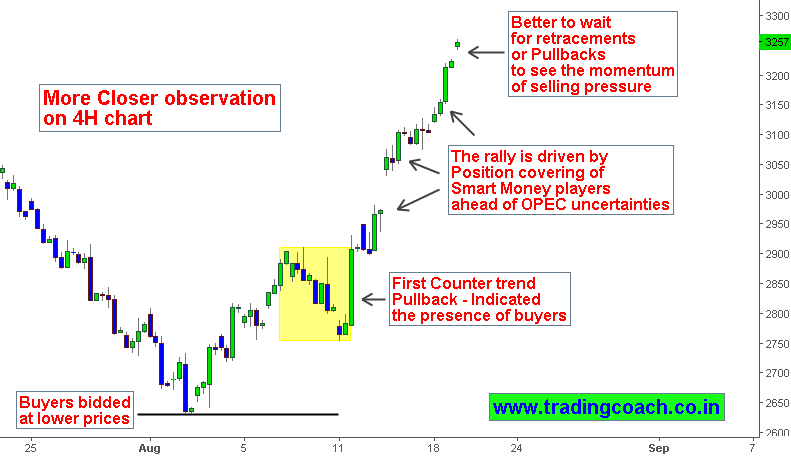

Market Structure Becomes Clear on 4H Chart

Closer observation on 4H chart reveals the structure of current rally in Price action. The price rally is because of potential future talks on freezing crude oil output levels. But it’s also worth to note that similar meetings earlier this year failed to produce any results. So it’s better to watch how selling pressure reacts and traders must wait for retracements or pullbacks. Also keep an eye on important speeches and announcements from OPEC.