It’s been a while since I wrote about Nifty 50 – After my previous article which I wrote couple of months ago, Nifty and its counter part sensex experienced a rise in Volatility and decline in FII investments. It precisely happened when the bench mark crossed 10000 psychological level.

Nifty 50 Price action Analysis on Daily Chart

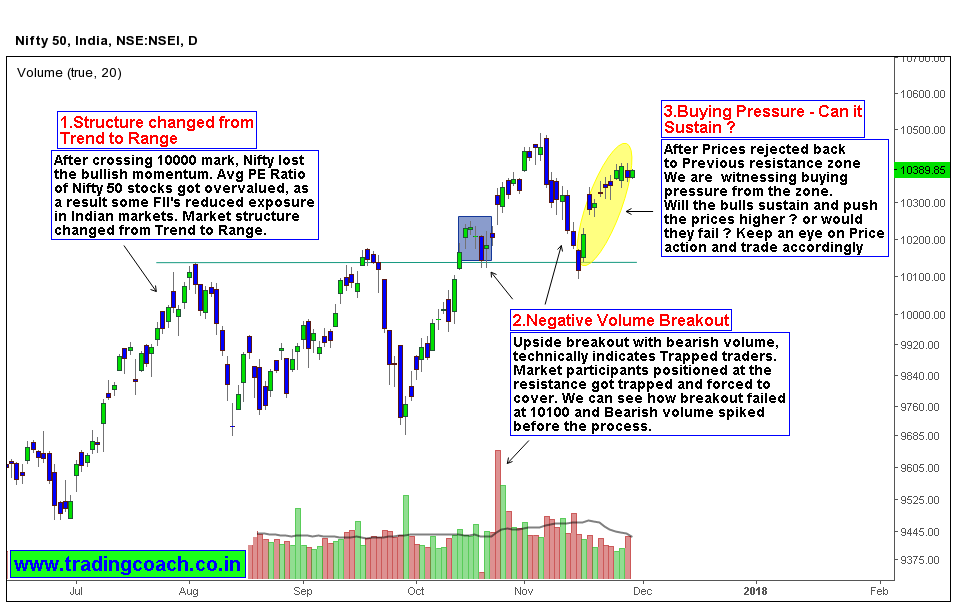

When we look at the Daily chart of Nifty 50, it’s obvious to notice that Nifty lost the bullish momentum after crossing 10000 mark (on Jul – Aug). Apparently during the same period, Institutional positioning reports showed outflow of Foreign Investments and non change in Domestic Investments. Fundamentally Avg PE Ratio of Nifty 50 stocks were also over valued. As a result of all these factors, Market structure changed from Trend to range.

Another interesting incident took place (in the period of Oct – Nov) and it clearly reflected in the chart through volume and Price action. Upside breakout with Bearish volume – which indicates trapped traders, especially weak hand traders who initiated long positions after the breakout were squeezed out from the market. Market participants positioned at the resistance zone 10100 got trapped and forced to cover. This formation is known as “Negative Volume Breakout” which is a preceding sign of Breakout reversal.

Now we can witness some buying pressure from the resistance zone (Marked in Yellow circle), seems like bulls are making an attempt to push the prices higher but unfortunately volumes are not in favor of bulls – Will Bulls succeed in taking prices to new highs? Will the buying pressure sustains? Keep an eye on Price action and developing market structure for answers. Traders and Investors must remember that, December Market might be sluggish and volatile, so take your trades and manage your open positions by keeping the fact in mind.