In earlier contents, several times I have emphasized about the Intermarket relationship between USD/INR and Nifty 50. In our proprietary trading strategies we combine Intermarket analysis with Price action to take short-term and swing trading decisions. So when we find any trading setups in Nifty 50, we always cross check the price action of USD/INR. The correlation between these two assets provides an excellent insight about FII’s or foreign Investors.

Incase if you’re not sure what Intermarket analysis is, then go through this – Understanding Intermarket analysis

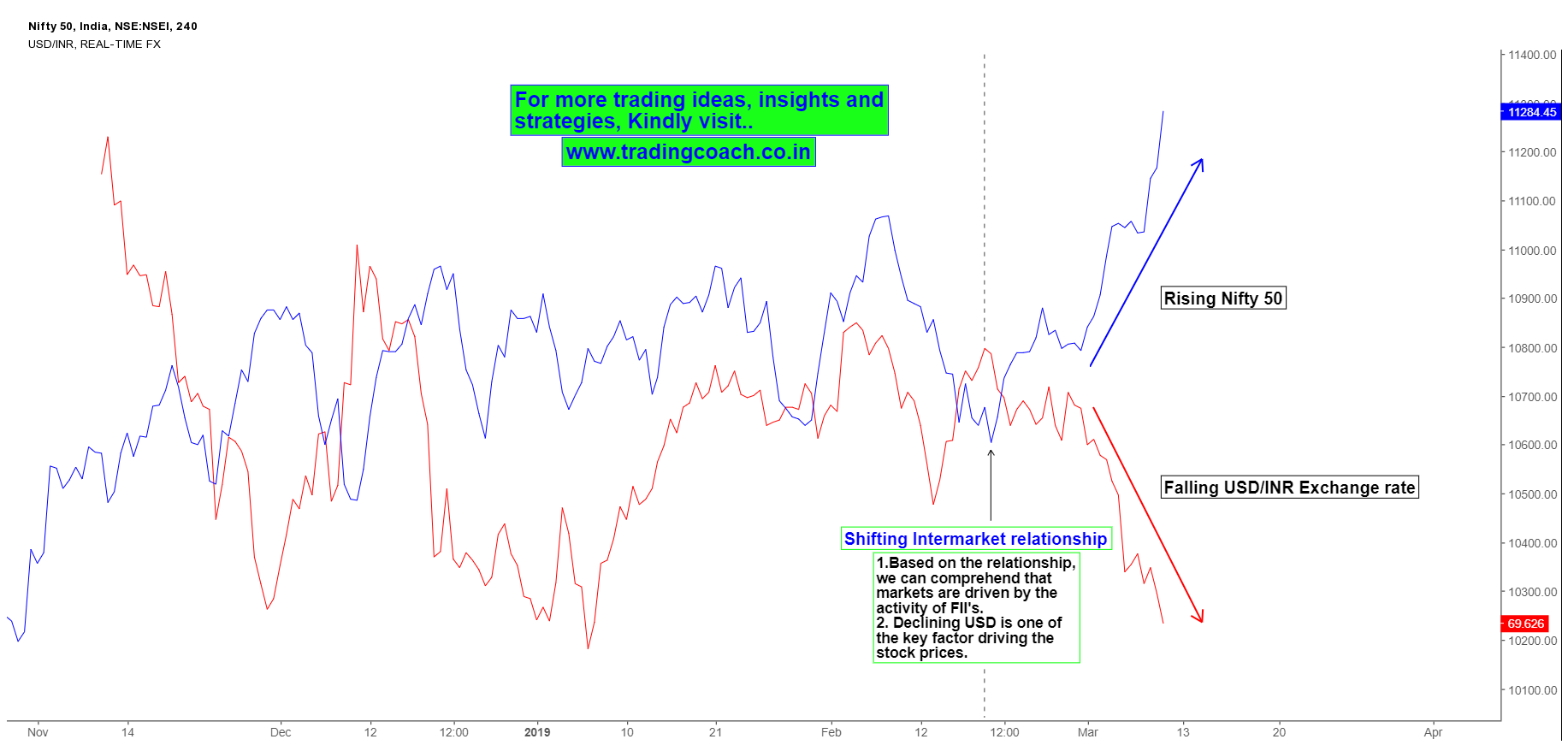

Shifting Intermarket Relationship

Declining USD is Boosting the Stock prices

From last couple of days, we’re witnessing sharp price rallies in Nifty 50 and other major blue chip stocks. Most of the analysts are attributing the recent moves with upcoming Indian elections but I guess there’s another important reason – Declining USD value against INR. From a historical perspective, declining USD/INR value had a positive impact on Indian share prices.

At present, USDINR is depreciating since from mid – February. If you look at the correlation chart (diagram that’s mentioned above), Nifty started to rise from the same duration and time period. Based on the observation, it’s obvious to comprehend that FII’s and foreign inflows are driving the stock prices in the current context.

Large cap Stocks that are trading at reasonable valuations and increasing Indian rupee rate is attracting foreign investors. The corresponding correlation ship we see in USDINR and Nifty 50 is because of the same reason. Based on the current scenario, we can comprehend that declining USD is one of the key element that’s influencing the Market behavior.

Traders should keep an eye on the price action and Intermarket relationship between USDINR and Nifty 50. When the markets become volatile again, we can look at the correlation between these two scripts and take some directional cues.