Brexit events triggered risk off trades in emerging markets. The effect on safe heaven assets such as gold, silver and Japanese yen is repercussion. Nifty followed the track of other emerging indices was starkly dominated by liquidity factors and positioning imbalances. FII flows – USD/INR will give better picture on Investor’s sentiment. In exception, Price action traders should focus on gaps in 4h chart.

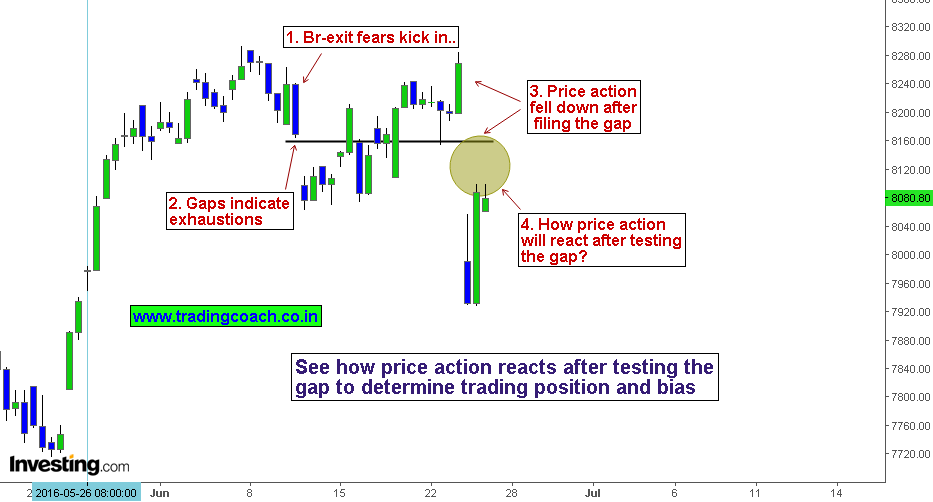

Below is the 4h chart of Nifty price action

1. Though participants became aware of Brexit issues recently, Markets were already hardwired for what’s about to come. In other words, Market discounted Brexit fears before the event actually took place. We can see that Nifty’s price action followed the suit.

2. Price gaps offered some potential clues about market structure, liquidity and volatility factors. Overall price structure was consolidating and didn’t have much conviction behind the movements. Exhaustive price gaps are due to low conviction and gradient shakeout. This means market is uncertain.

3. Earlier, Price action fell down after filling the gap. We can see strong bullish candlesticks leading the price action while filling the gaps. The strength of bulls are visible at hindsight behind such movements, but selling pressure is still intact as we see Nifty making lower lows.

4. To predict whether the current market structure continues or not, we need to observe how price reacts after testing the gap. Market action after the retest of price gaps will provide clear picture about sentiment.

Traders should see how price reacts at gaps and movements preceding the price gaps. We should also notice whether prices are making lower lows or creating any imbalance opportunities. Observe price action to determine trading positions and trading bias in Nifty.