Since the beginning of week, Selling pressure is dominating Nifty due to profit taking by Institutional traders ahead of GST bill and Upcoming macro factors. Even today markets continue to remain volatile and broader markets under performing overall.

Market participants are pricing in the expectations and speculation about GST bill and major economic events that will play out in the coming days. Nifty is not playing all alone; it is in symmetry with Asian and European Markets. Japan’s Nikkei fell 1.5%, France CAC is down 1.7 % and Germany’s DAX fell 1.5%. Selling in Europe and Asian Markets shows both domestic and International factors are Influencing Nifty’s Price action.

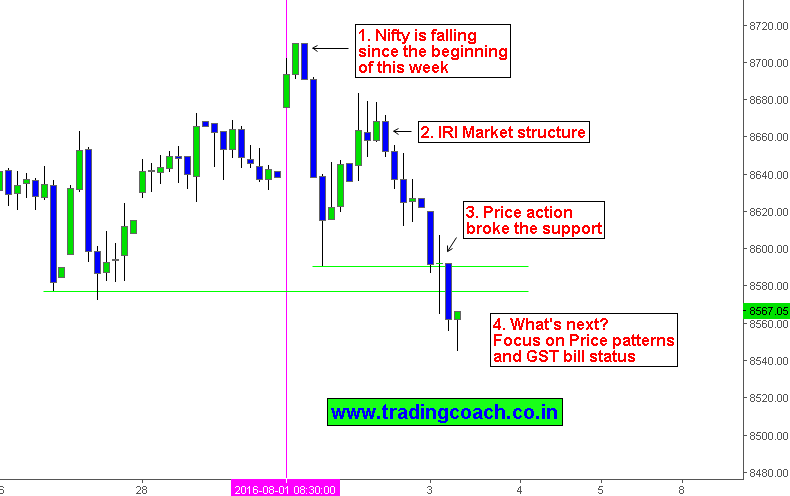

Using Market structure analysis we can note that Price action has formed IRI Pattern in Nifty

1. Nifty has fallen since the Beginning of this Week. August seasonality could’ve played a major role in determining the market conditions. This week’s high is currently at 8711

2. Market has formed an IRI Pattern (Impulse – retracement – Impulse pattern). Timing of the formation is quite notable. We will see how the structure plays out after GST bill.

3. Price action broke the support zone 8600, 8575 and currently holding at 8550. All these key levels must have contained some imbalance tendencies.

4. Traders should look for price patterns before or after GST bill announcement which will be a reflection of Market’s buying and selling pressure. Keep your eyes on Major support and resistance levels.