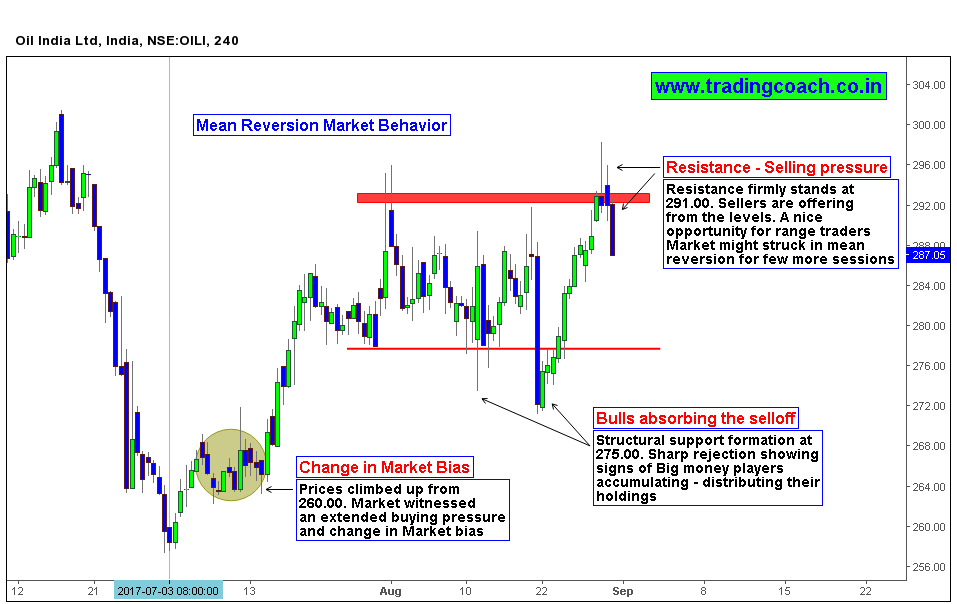

Oil India Share prices reflecting mean reversion Market behavior. It’s obvious to notice both upside and downside swings through Price action. We can witness both buying and selling pressure in the stock at consecutive highs and lows. Since Oil Industry is prone to International Crude oil price fluctuations, it makes sense to understand recent moves in that context.

The market sentiment and bias shifted to upside from the end of July. Prices rallied from 260.00 and market saw extended buying pressure. Likely the reason has to be Big money players liquidating their previous short positions after an extended down move. Price action and market behavior at 275 structural support zone indicates their involvement. (Big Players can’t hide their hands everywhere!)

Resistance level at 291.00 is capping further advances, as some good offers seem to exist at the level. Multiple Price rejections, false breaks are signs of Mean reversion behavior. Increasing volatility and vibrant two-sided fluctuations makes it an ideal stock for range trading. Traders should watch and capitalize on range trading price action setups.