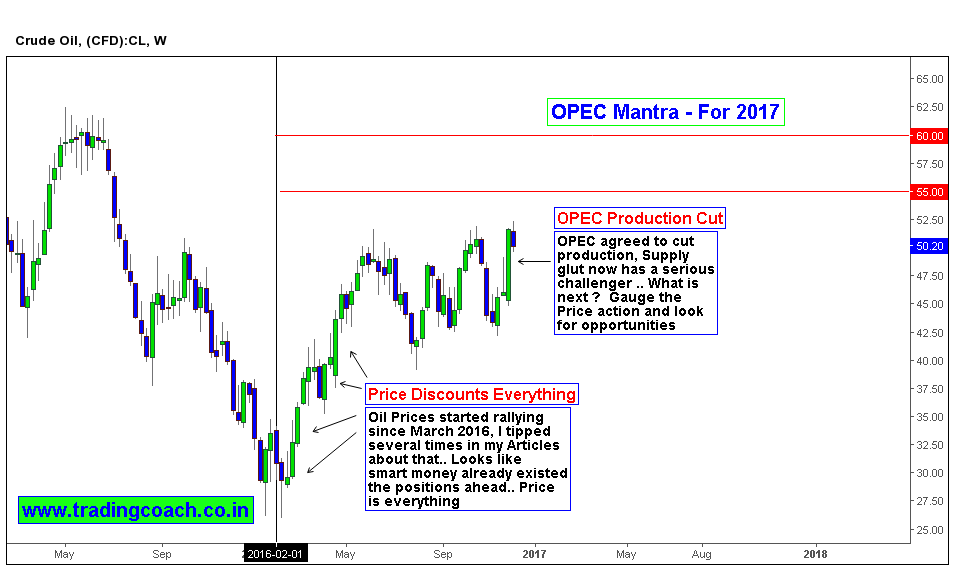

OPEC producers, despite the obstacles agreed to limit the crude oil production and the oil prices sustained. Now the Question is “Will the OPEC Decision stabilize oil prices in 2017?” Morgan Stanley forecasts rise in the U.S. shale drilling and investment from Asia to the North Sea limiting oil’s upside while Goldman Sachs Group Inc believes in price retreat back to $50 a barrel in the second half of next year after possibly rallying higher than $60. Japan’s Mitsui & Co., which owns U.S. shale assets, sees oil decline to the $40 for the last six months. Keigo Matsubara, CFO, of the Japanese trading house sees rise in Oil up to $60, but increase in shale drillers eventually decline the oil price and that it cannot continue over $50.

These Predictions are from deep pocket major players in the field of Crude oil trading. Just read the names one more time to get a glimpse! The oil price stabilised after OPEC agreed to cut supply since 2009 to ease the global glut. The OPEC’s largest producers, Saudi Arabia, Iraq, and Iran agreed to the cut the output. The West Texas Intermediate crude prices surged 9.3 percent to USD 49.44 a barrel, on the day of announcement.

According to International Energy Agency Executive Director Fatih Birol, oil price will surge because of successful OPEC agreement to cut production, could be snuffed out if supply surges back, and increase in the production may trigger decline in the prices.

Many believe oil prices cannot sustain above $55 a barrel, with global production responding first and foremost in U.S. OPEC’s deal was targeted more at reducing excessive global inventories and not seeking higher prices. By eating away at the global glut, the forward price curve flattens, reducing hedging gains by high-cost producers and helping lower-cost suppliers grow market share.

Targeting higher oil prices above $55 would be “self-defeating“. The possibility of US shale producers coming back to market increases. Crude oil may end in a reflexive feedback loop. One thing is for sure, 2017 will create marvelous trading opportunities in crude oil for both trend traders and range traders.