The “old is gold” phrase doesn’t work well in the investment market, as an example- these are 5 firms which are registered on BSE in 19th century. (when the historic Revolt of 1857 took place.) Hardly few people knew these stocks are so old like 19th century. For last three to five years, as per the Investment statistics, these 4 stocks aren’t providing any income to investors, despite being favorite stocks due to branding.

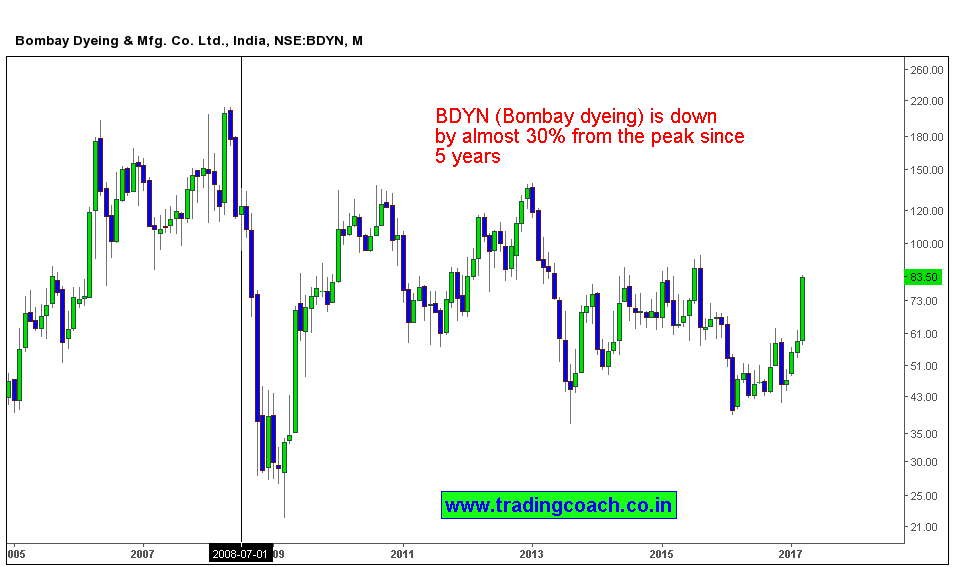

Bombay Dyeing And Manufacturing company (BOMDYEING)

Bombay Dyeing which is under Wadia Group incorporated by Nowrosjee Wadia in the year 1879 on August 23rd is one of the largest textile manufacturers in India, but its stock prices are down by 30 percent in last five years on returns adjusted basis (though it is up by 15 percent in past three years.)

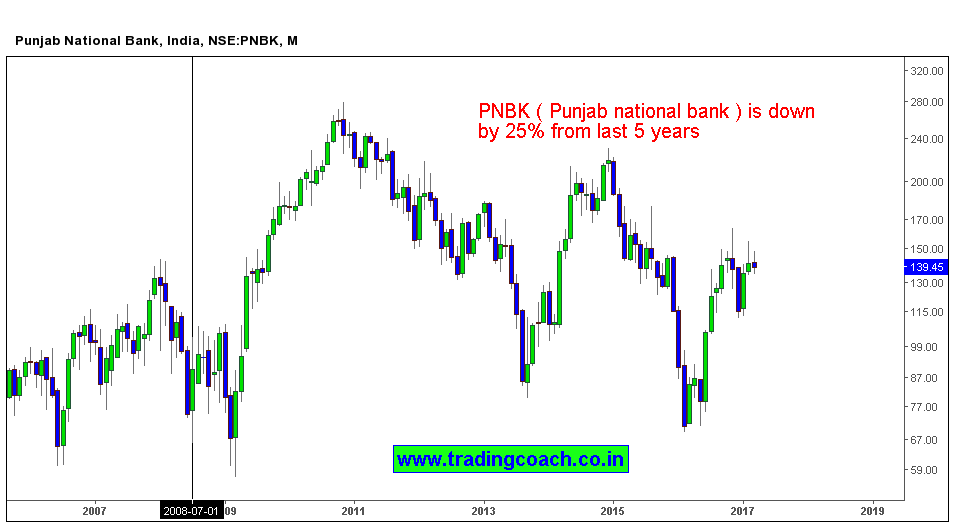

Punjab National Bank (PNB)

High NPAs on the balance sheet of public sector banks, causes huge pressure and reduces operating profit. For instance, Punjab National Bank which was established in the year 1895 and got enlisted on BSE in the year 2002 is down by 25 percent in last 5 years with a little upside of 16 percent in previous three years.

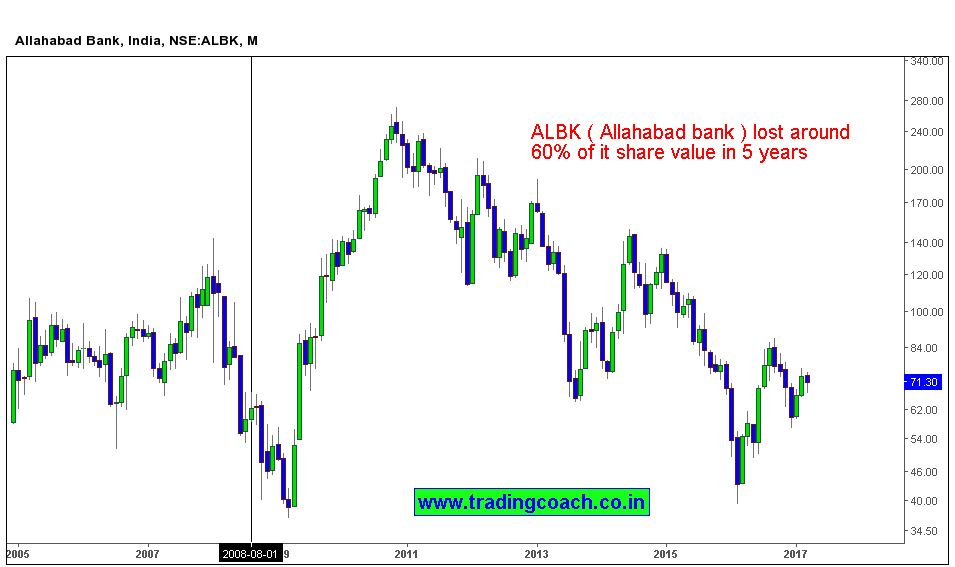

Allahabad Bank (ALBK)

Another PSU bank, Allahabad Bank, the oldest in India is down by 12.7 percent in the past three years and to everyone’s surprise, it is even down by 63 percent if you take the results of last five years. The bank was founded in the year 1865 and was introduced to the Dalal Street in the year 2002 and the government is reducing stakes consistently on this bank (Publicly reduced to 71.16 percent and currently it is 65.92 percent.)

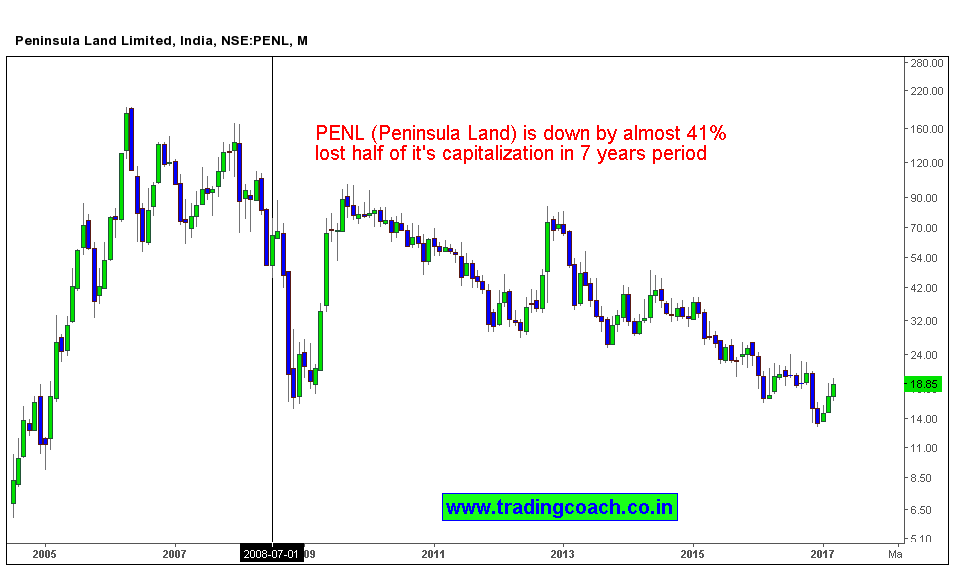

Peninsula Land Limited (PENINLAND)

Another example of these 19th-century stocks which isn’t generating any returns is Peninsula Land – a realty company under Ashok Piramal Group. The market value of this stock fell by 41 percent in the last five years and almost half of its market capitalization if you take into account past seven years results. The company was established in the year 1871 on 10th of august as a textile company and it is was then called Morarjee Gokaldas Spinning & Weaving Company.

In last 5 years, BSE Sensex rallied up to 69 percent – which clearly indicate these above mentioned shares aren’t performing well at all. Though they are old firms, they are not at all good investments. So be careful, when you pick stocks by brand or capitalization next time!