Telecom Sector shares are witnessing high volatility, declining investors confidence and Pessimistic sentiment – all because of Reliance industries! Jio is trying to gain an upper hand in telecom business by wiping its competition. Leaving the debate and rumors aside, let’s see what charts are telling us about Reliance Industry share Prices.

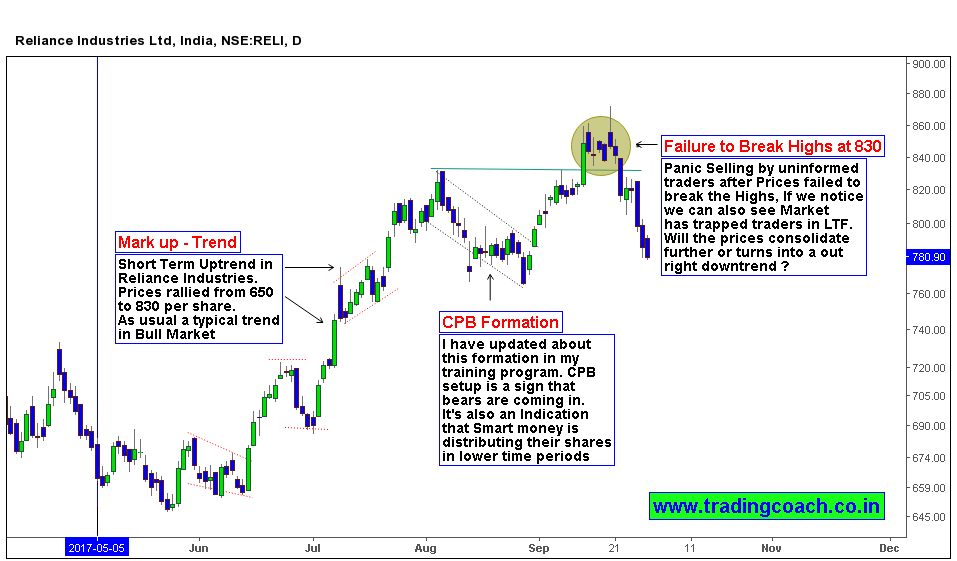

Below is the Daily chart of Reliance Industries (NSE: RELI), along with observation and Price action analysis.

Share Prices rallied from 650 – 830 in a span of 3 Months (from Jun – August), following typical Bull market in sensex and Nifty. Investors’ expectations were driven by initiatives of Reliance Jio to capture Indian telecom business. Many trend trading setups and strategies worked out very well during the time.

But in Mid August, Market structure experienced a shift. Stock Prices made a new high at 830, Smart Money participants such as Insiders; FII’s started liquidating their positions whereas DII’s kept accumulating the shares. During the same period we saw a rise in volatility and bear traps on Lower time frame. Later, Prices rallied and recouped earlier losses.

At the end of September, Price action retested the previous high (830) but failed to break above it. Failure to break the new high made market participants more skeptical and uninformed traders started selling with panic mood (Most of them are lower time frame traders). What’s next? Will the prices tumble further downside? Or will it trade sideways? Watch the developing Price action for answers. Combined initiatives and promotions by Jio – Apple also will have an Impact on share prices. If we spot any trading setups, we can play with tight risk management.