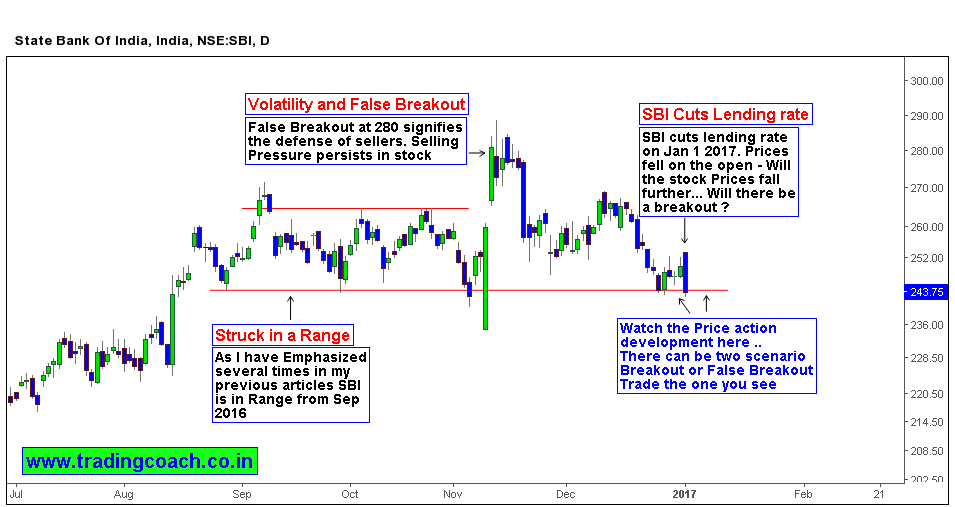

SBI Share prices are consolidating since September 2016. I have updated that several times in my earlier articles. As anticipated by market participants, India’s biggest lender by assets cut down its Interest rates by 90 basis points. Will this lead to a Breakout in stock prices?

The recent rate cuts are applicable for maturities ranging from overnight to three-year tenures. The move is a positive result of demonetization, especially for consumers. Stock prices fell on Monday open, after the announcement.

Flipping the Daily chart, we can spot that SBI Price action in the verge of support level 240.00. By combining recent selloff and lacking momentum of buyers, we can conclude that stock is still in Bearish bias. Right now there are two possibilities, either Prices will breakout (if there is enough selling pressure) or may result in breakout failure (if demand comes back.) This stock will be in my watch list for swing trading, due to the confluence of both fundamentals and Price action.