ICICI Prudential asset Management Company which overlooks $29 billion worth of assets is making bullish bets on power utilities and finance companies as per the firm’s fund manager S. Naren. India’s biggest fund manager applies a discretionary macro technique which relies on statistical data of consumer spending in soap, toothpaste and travel and electricity usage to take trading positions. Normally macro traders rely on economic output measures such as GDP, Inflation and money supply but Naren’s approach marks a difference. Also he pointed out that sub par monsoon or rising oil prices would contradict his bullish bets.

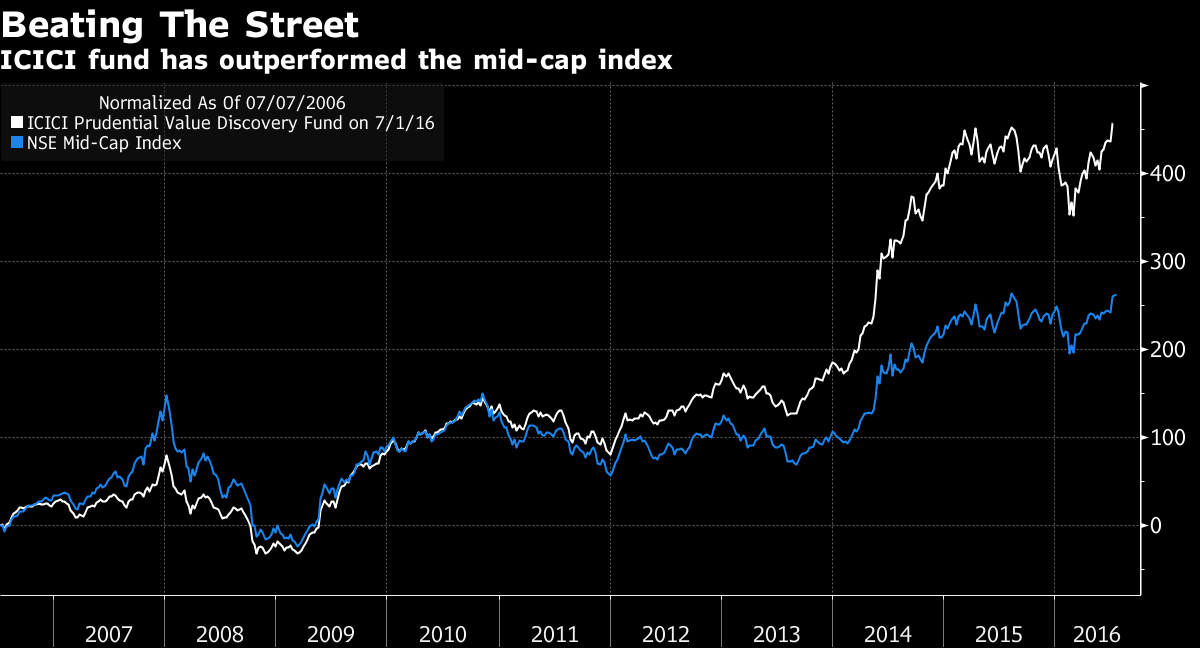

1. ICICI prudential discovery fund has climbed 20% annually in five years through June outperforming 95% of its competitors. When compared with Nifty midcap index which gained 14% yearly on average during.

2. The fund has invested 30% of its 132.1 billion rupees or $2 billion in banks, engineering firms and drug makers as per fund inflow reports on June 30.

3. S&P 500 BSE sensex increased 6.5% in June quarter which is lower than firms’ actual returns.

4. More investors are growing skeptical on India’s headline numbers ever since government changed its statistical calculation which measures growth. Growing number of people are questioning the legitimacy of method. Swing traders and positional traders can keep an eye on Utilities and finance companies for valid price action setups.