It is evident that stock market is full of surprises. In past three years, few sectors which are neglected by most analysts and Investor have given abnormal returns. Rare stocks from unnoticed sectors like Glass, Hydraulics, Gases or LPG & Aquaculture have performed unpredictably well and surged nearly 1500% during the period of 2014-2017 till date.

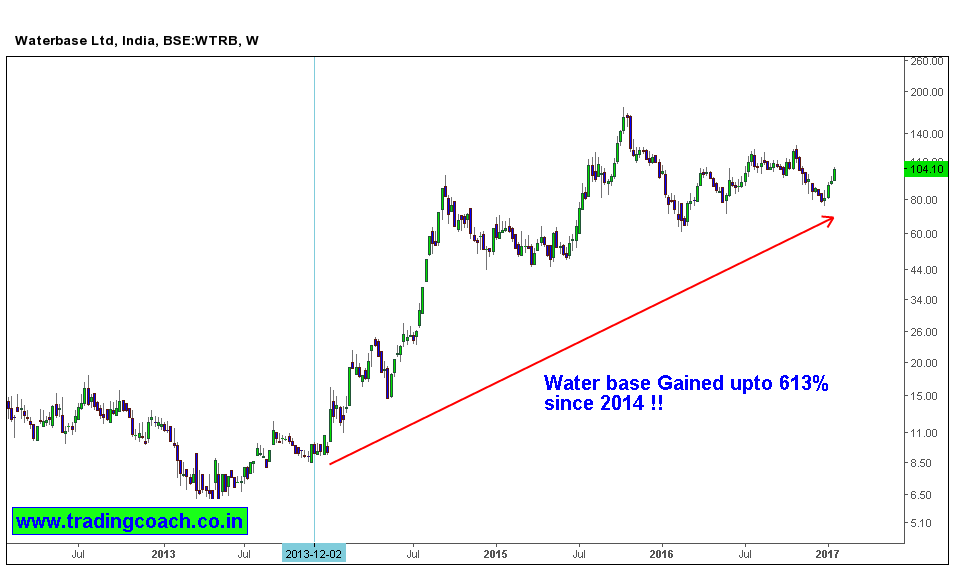

Aquaculture

Aquaculture sector is hardly followed by popular analysts; even very few people trade these stocks. Waterbase which is a shrimp feed manufacturing company and a leader in the industry (mostly because of better quality) rose 613% in last 3 years. WTRB was trading at 13.22 in the year 2014 and now it is trading at 100.

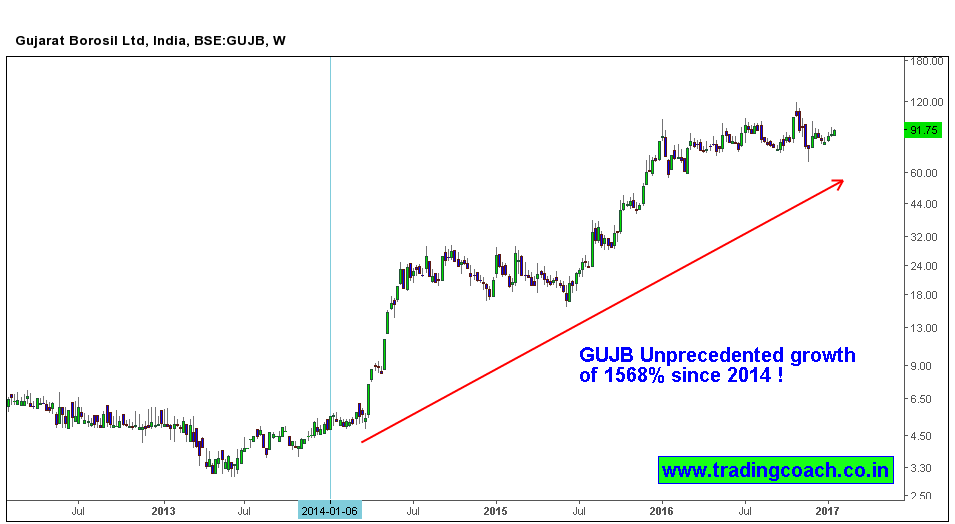

Glass

If you are paying attention to glass sector, you must have noticed Borosil Glass, La Opala RG surging up to 829% and 292% from 2014 to 2017 respectively. Gujrat Borosil, unpopular stock, on the other hand, surged up to 1568%, GUJB was trading at 5.26 in the year 2014 and now it is 90.00, which is quite an abnormal return.

Other stocks from this sector include Asahi India Glass Ltd. and Saint-Gob. Both of these glass manufacturing companies showed a growth of 323% and 285% over the last three years, respectively. This kind of growth can’t be seen in any buzzing stocks recommended by Analysts.

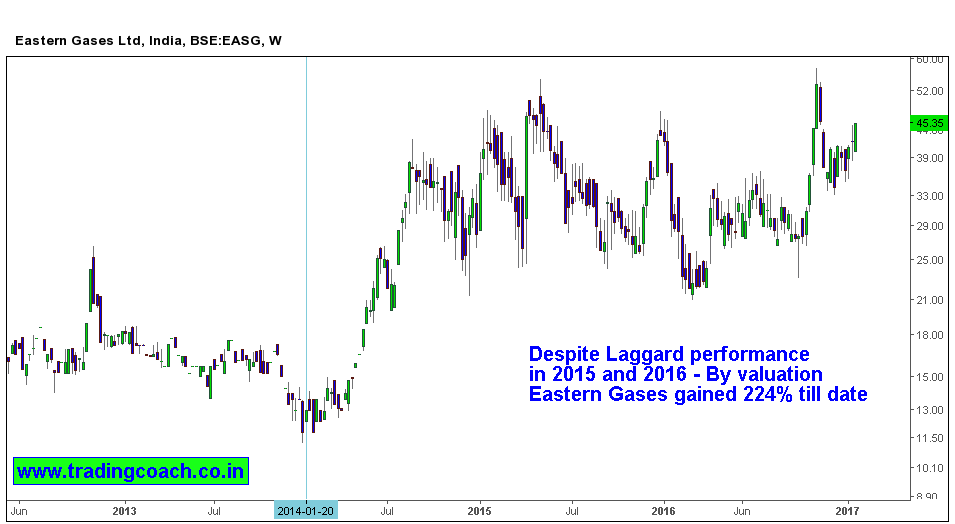

LPG Gas

Eastern Gases, a private company which supplies fuel to various industries and businesses gained 224%. Despite the doldrums of falling Natural gas prices and skewed profit margins, EASG managed to sculpt its mark in such a turmoil period. Though it stumbled on 2015 -16, was able to hold the gains through volatility. Now It is trading at 41.9 and in 2014, it was at 12.94.

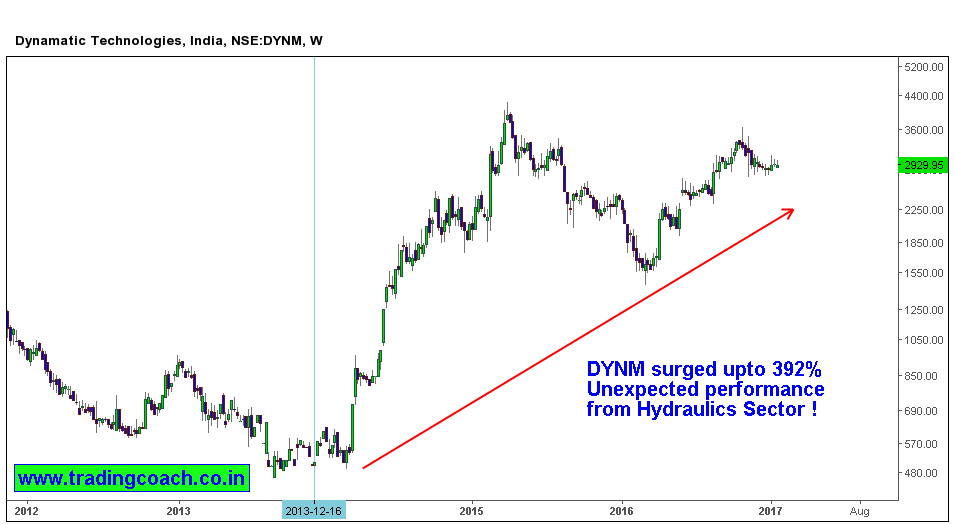

Hydraulic

The hydraulic sector is another neglected sector, three stocks from the sector – Veljan Denison, Yuken India, and Dynamatic Tech surged up to 233%, 317% & 392%, respectively leading the sector. We saw many popular analysts who desperately downgraded DYNM for last few years.

The overall market growth according to NSE Nifty (NSEI) and BSE Sensex (BSESN) is only 28% over three years. On the contrary, these above mentioned stocks have risen almost 50 times more than the estimated growth. Conclusion of the story is – Traders and Investors must pay attention to unpopular sectors and shouldn’t blindly follow the recommendations. While most analysts were busy estimating profits of popular sectors like real estate, technology etc. Unpopular stocks gave abnormal returns. Is it a folly or Ignorance of Market crowd? It’s upto you to decide.