Nifty 50

RELATED postS

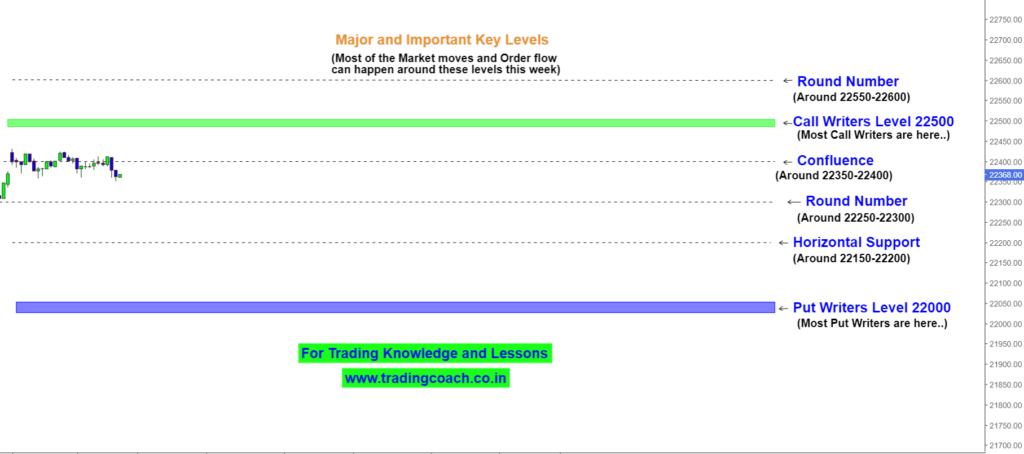

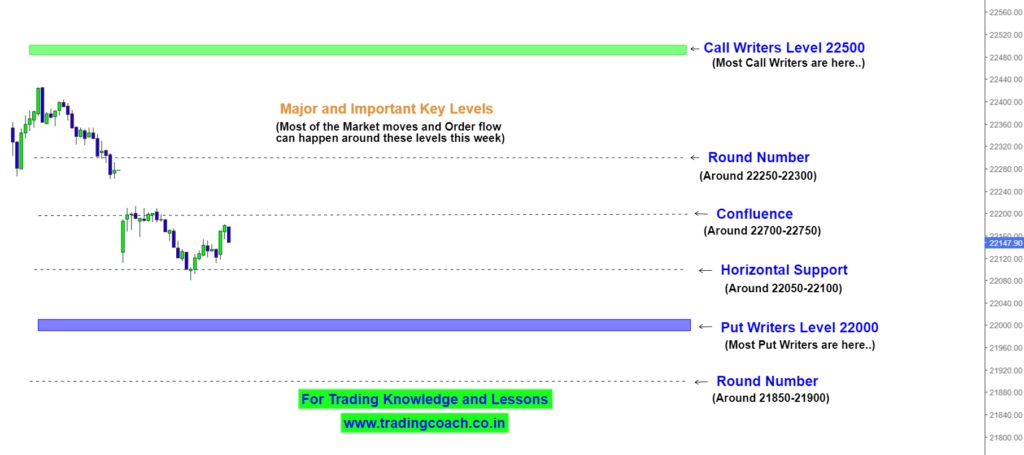

Small traders who have made incorrect trades around these levels may find themselves trapped and forced to liquidate their positions. Take a look at my Nifty

In the previous article, we looked at important support and resistance zones, also what I call as Order flow Levels for Nifty 50 The title

Small traders who have made incorrect trades around these levels may find themselves trapped and forced to liquidate their positions. Take a look at my Nifty

In the previous article, we looked at important support and resistance zones, also what I call as Order flow Levels for Nifty 50 The title