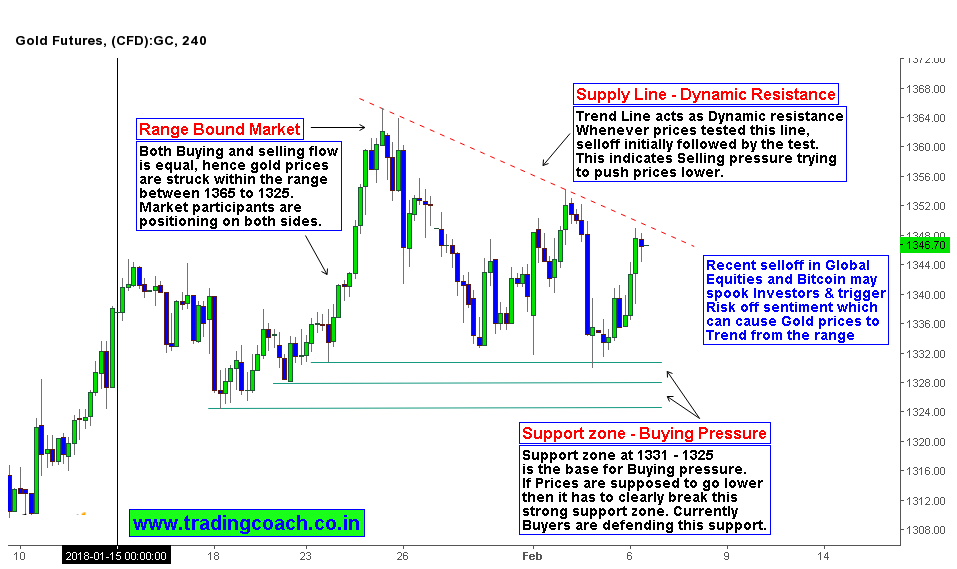

From Dec 2017 to date, Gold prices gained almost 12% so far. In the current scenario, when we look at the 4h Chart of Gold (International Spot prices), price movements are struck in the range of 1365 – 1325. Based on chart reading we can assume that both Buying and selling pressure is almost symmetric. Large Market participants such as Funds, Portfolio managers, Smart money players are positioned on both sides.

Falling trend line from 1368 acts like a dynamic resistance, caps the advances from Bulls. Previously when prices tested the trend line, we saw selloff followed precisely aftermath. Buying pressure has formed a basement at 1331 – 1325 which acts like a strong support zone for bulls. These two technical zones are the important factors for future Market direction; the present context signifies a Neutral market condition for Gold.

But the sentiment can change and Gold prices might breakout from the Range in coming days. The primary reason has to do with sell off in Bitcoin and Global Equities. If Stocks and bitcoin continued to fall further, it can make global Investors more worried. They might start diversifying into safe heaven assets, which can cause Gold’s Price action to breakout and trend strongly from the Range. So Short term traders and swing traders, its time to keep an eye on Gold for Potential sentiment changes and Price action trading setups.