Indian Rupee fell to 68.75 a dollar in February, near an all time low of 68.84. After Indian government’s budget announcement which helped revive investor confidence in local assets made prices rally 2.4 percent since then. In the perspective of trade mark exchange rate USD/INR, the currency pair has broke out and retesting the support level at 67.10. Some traders are pointing out Indian rupee can’t sustain the rebound from its record low.

5h chart of USD/INR for price action trading

1. Overall structure was down, as prices are making lower lows only in the context of 5h chart. Whereas in daily chart asset is in ranging market.

2. USD/INR found support at 67.100, which was also a radar level that has streaming imbalances of liquidity.

3. Candlestick made sharp rejection at 67.60 later turned to be a resistance level indicating the selling pressure.

4. Another retest at 67.10 resulted in lower time frame consolidation. This structure trapped several traders on both sides since it is falsely perceived as breakout. It’s a significant trading setup which is either breakout or breakout failure. Traders can play this setup in direction of prevailing market sentiment.

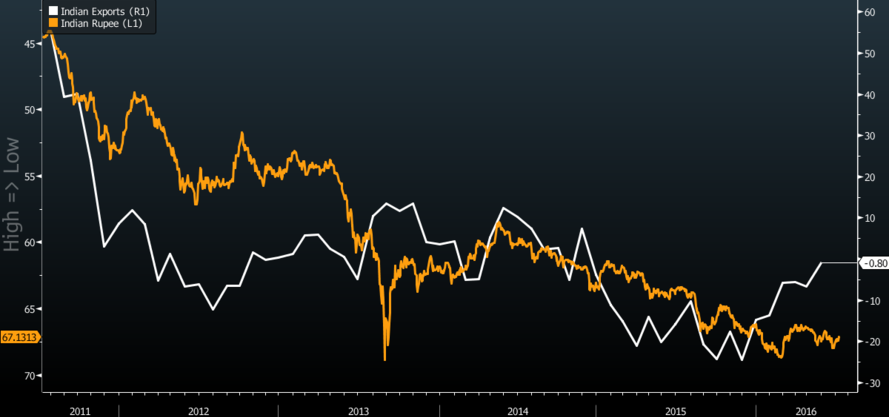

Indian rupee is not affected by domestic fundamentals

India stood out as a safe haven after Britain decided to exit the European Union. The anxiety and global fears created a knock on effect in Currency prices. The event attracted potential off shore assets and hot money into the sub continent. This knock on effect can be temporary or sustainable depends on upcoming sentiment shifts.

In the above graphic we can observe that exports didn’t have any effect on currency prices which will help us to conclude that Domestic fundamentals are null factors for Indian rupee. Traders should keep in tab with central banks policy and international finance factors to predict the trend.