Price swings in USD/INR have dropped in fastest pace aftermath Brexit due to strong inflows into Indian assets. Foreigners are investing in Indian bonds and debt instruments because of strong monsoon which eased inflation expectations and India’s appeal as highest yield provider among major Asian Markets. 10 year government bonds attracted foreign inflows following Brexit due to its highest yield. The inflows have kept volatility much lesser than average in USD/INR.

International ownership of domestic bonds and corporate notes has increased by 67.8 billion rupees rising for 10 straight days since February 2015. It dropped in previous two months as inflation accelerated causing investors anxiety. Local stocks have lured inflows of $1.06 billion this month.

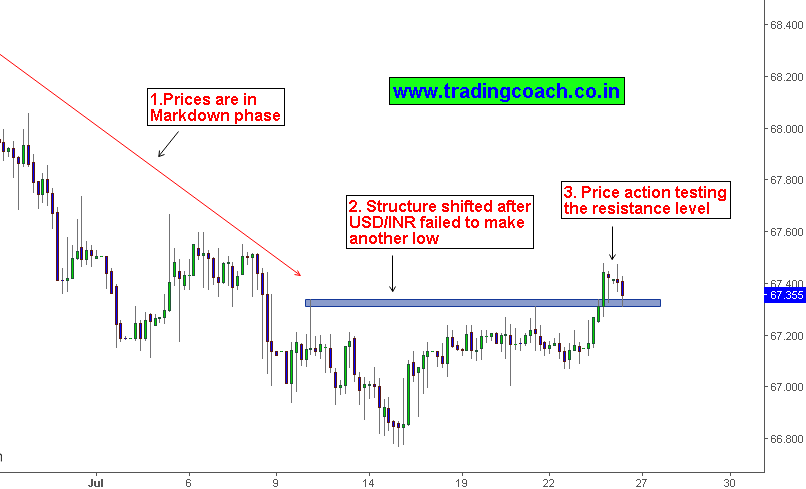

USD/INR Technical analysis on 4h chart for Price action trading

1. Prices started falling down from June 27th and market kept making lower lows till July 15th. Technically it’s a Mark down phase.

2. Market structure shifted to ranging price action after USD/INR failed to make another low. The move indicates the buying pressure.

3. Price action is testing the resistance zone at 67.40 – 67.30. From the perspective of Lower time frame it’s a breakout structure.

Traders should observe the resulting price behavior following the test at resistance zone. It can either be a breakout or breakout failure. Also be focused on support – resistance levels at 67.071 and 67.48

Declining volatility of Indian Rupee

USD/INR monthly implied volatility used to price USD/INR options dropped 131 basis points since June 23. In spot market Indian rupee strengthened 0.3 percent in July after three months of consecutive declines.

The attractiveness of nominal yields and implied volatility is influencing the market sentiment of USD/INR. Wider price swings in US dollar, reform progress of central government and confirmation of RBI governor and his monetary policy stance will drive the price action of Indian rupee. Traders must keep in touch with fundamentals and focus on Technical analysis.