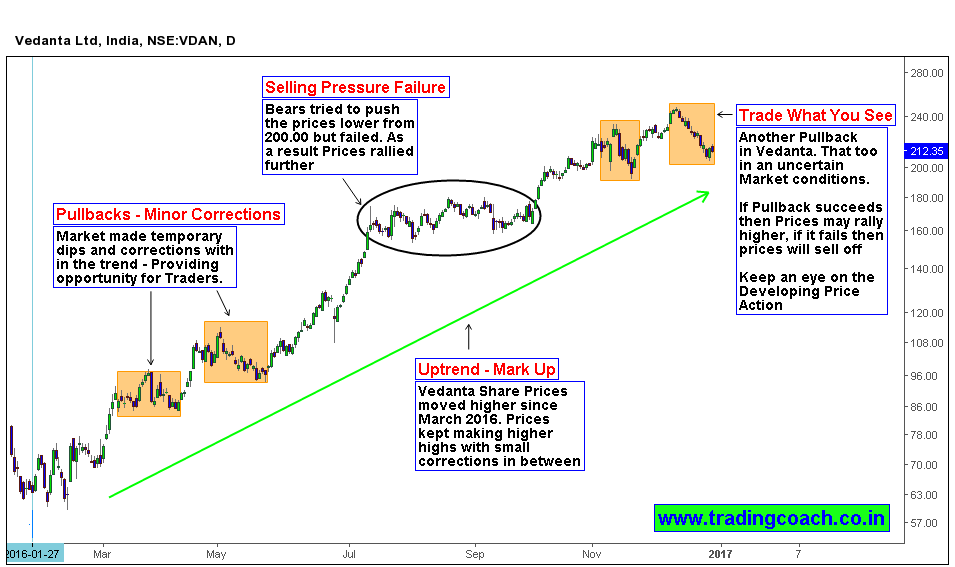

Vedanta, one of the most actively traded stocks in Exchange. One of the top performers this year, despite the obstacles of Demonetization and uncertainty, Vedanta shares managed to hold its earlier gains. When we observe Daily chart, we can spot uptrend that’s in place since March 2016. After crossing 200.00 price level, shares came under persistent selling pressure. Though bulls managed to keep the uptrend intact, it seems demonetization impact and volatility will challenge the Buying pressure in coming days.

Take a look at Daily chart of Vedanta Share Prices, Bears started haunting the stock after it crossed 200.00 and bulls desperately kept pushing the prices higher. Now again bears are hitting from 250.00 (Potential Supply – Resistance level). Will the bears succeed in this attempt? Is there any possibility of Vedanta Share prices slipping into correction? The answer depends on developing price action. Right now there’s a pullback formation in Daily chart, if pullback fails then prices may swirl into moderate correction. If it succeeds then prices may travel further upside. Watch the Setup for market direction and sentiment. Also keep an eye on upcoming fundamental factor that affect the stock prices.