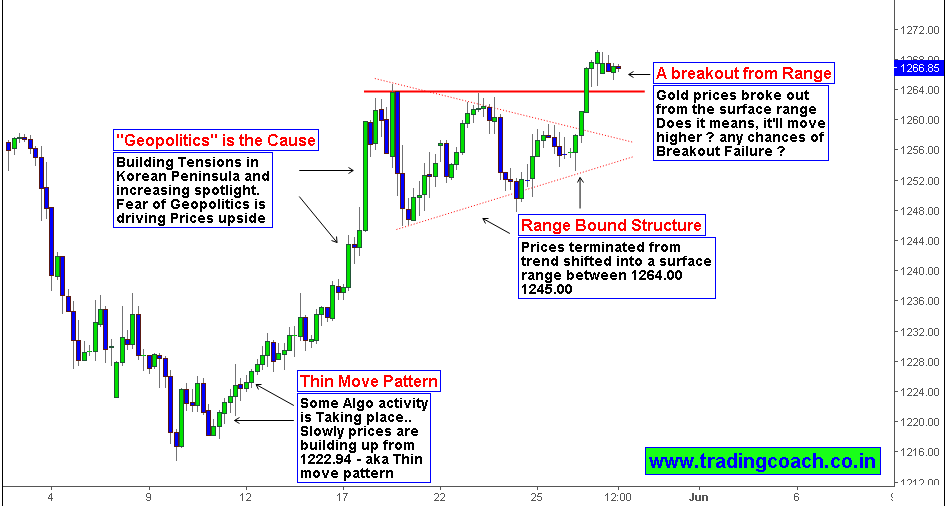

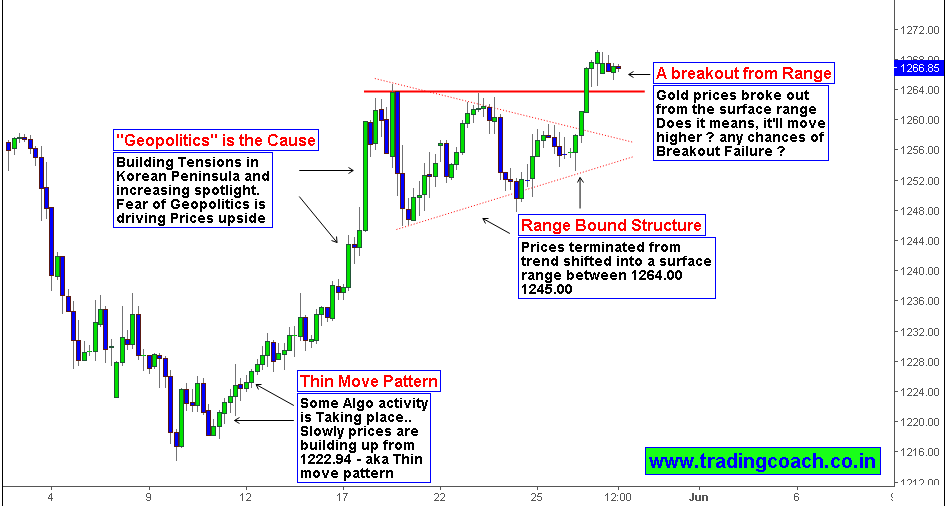

The precious metal is riding on a bullish tone from couple of weeks. Prices are rallying from the beginning of May, what’s the reason behind Gold Prices? Is it seasonal factors or Indication of bottom? Is it finally a time to put gold back into asset portfolios? Will the prices fall from here again? Like these, many questions are troubling Investors and speculators. Here’s my take..

Well to be honest, none of these are adequate to explain the recent rally. Gold is a metal of fear – when there is an uncertainty or fear, liquidity will flow into gold. The current Price action is another example. The main reason behind gold‘s rally from $ 1217.00 to $1270.25 is escalating diplomatic tensions within Korean peninsula. When North Korea threatened with more missile tests, gold formed a Climatic pattern from $1238.00 to $1260.00.

Once the fear subsidized and media’s attention shifted, Gold surfaced into a range bound structure on May 18th (traded within $1264.00 – $1245.00 till May 26th.) Right now we have a breakout around 1265.00, Will this setup succeeds or results in Breakout failure? Observe the resulting price action and keep an eye on Geopolitical tensions. More fear and Uncertainty means advantage for gold prices – vice versa.