Market Psychology and Price action Trends

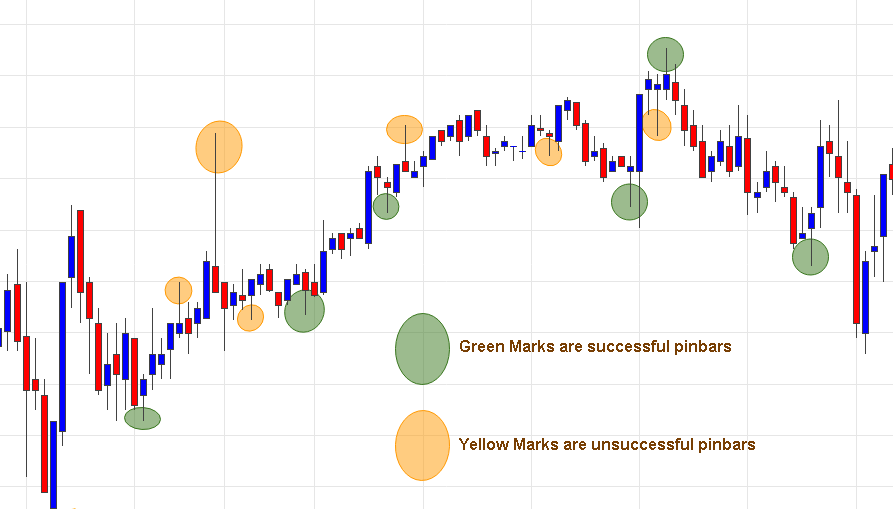

Supply and demand, when sellers and buyers agree on a trade, determines asset prices. Market Psychology has tremendous impact on asset prices. Presumably, if a substantial number of transactions occur at one price, the price is telling us that supply and demand are in a temporary equilibrium (Range bound) and that both buying and selling […]

Market Psychology and Price action Trends Read More »