IBULHSGFIN (NSE) Indiabulls Housing finance stock prices have rallied more than 80% so far, since from the month of April 2021. The Uptrend is very clear and obvious on 4h chart. Will this momentum continues even further? Well there are Possibilities!

Take a look at the Price Action Analysis.

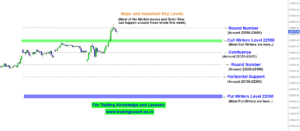

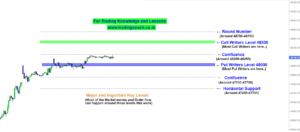

Price Action Analysis of India bulls Housing Finance Ltd. 4H chart.

We can notice the turning point from the mid of April, stock prices began to shoot up from 160 onwards. In the trend we can witness multiple pullback setups, after each consecutive pullback, stock prices rallied nearly around 20%.

On 4th of June 2021, Prices broke the long-standing Resistance zone at 250. After the Breakout, prices quickly retested the level and formed a Minor pullback pattern.

Looking at the Price behavior, we can notice a Clear Uptrend in India Bulls Housing Finance, a trend which has rallied more than 80% so far, from bottom to top. From the perspective of Richard Wyckoff, this is what he calls as a Mark-up Phase.

Along with the Uptrend, we can also witness a steady increase in the Trading Volume, which technically means more Orderflow is coming into the markets.

Considering all these factors, there are possibilities of trend continuing even higher; maybe the Stock prices could touch 300 and create a pullback and then continue higher. On the other hand, if Sellers begin to take control of Price Action, then Prices might once again test the previous resistance zone at 250.

If you like to take Volatility and risk in your positions, keep this stock on your watch list and trade according to developing Price Action.