Shares of Indian Jewellery makers jump after Central government reconsidered the rules for claiming tax on gold jewellery sales. As per modification and new rules, Jewellers with turnover up to Rs.15 crore ($2.24 million) is excluded from excise duty. Jewellers conducted strike for six consecutive weeks after govt imposed 1% excise duty on Gold jewellery sales earlier this year.

Tara Jewels Ltd – Price action rose as much as 10.74%

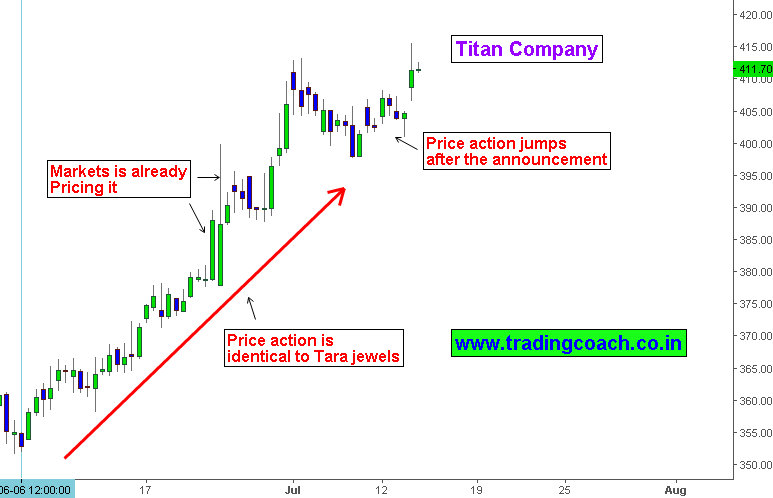

Titan company- Price action rose 2.9 percent after the announcement

A glance at modification and reason behind share market price climbs

1. Central Government has decided to increase SSI eligibility limit for jewellery manufacturers from 12 crores to 15 crores and SSI exemption limit from 6 crores to 10 crores in a fiscal year.

2. 1% Excise duty without input and capital goods tax credit or 1.5% with credit may apply to jewellery made of platinum, gold and silver

3. Excise duty is not payable on the sale of traded goods, records maintained for State VAT tax and other private records.

4. Movement of Jewellery which doesn’t involves any sales purpose is excluded from excise duty.

Market Psychology Factor

From a neutral perspective these rules are favorable for Indian jewellers will in turn reduce their liabilities in balance sheet. Also there are multiple loopholes which will be used for tax reductions. Investors could’ve perceived it as positive reason for stock prices which caused the price action to jump.