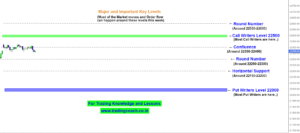

Alright, so we have an excellent short term uptrend in Nifty 50, since the beginning of October. So far, index prices have rallied from the bottom of 16800 and are now trading around 18250.

Due to the gloomy market sentiment, Bears and short sellers tried multiple times to reverse the Nifty, but couldn’t succeed!

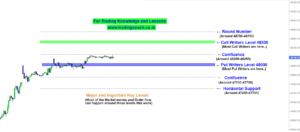

We can see the traces of failed selling pressure and trapped short sellers clearly on the chart. Take a look at the Price Action Analysis in the 2h timeframe.

Nifty 50 – Price Action Trading Analysis on 2H Timeframe

All the bears who tried to short the Nifty have clearly lost the game so far. The selling pressure could not sustain in the Index.

Will that change in the coming days? As we can notice some cracks in the Uptrend. We can see some signs of an over extended trend and over bought market conditions.

Another interesting point is that the Bears are once again trying to push prices lower. See the last few Bearish candles – It indicates good selling pressure.

Will the Bears succeed this time? Or will they get trapped as usual? Let me know your thoughts and feedback in the comments

To learn more about market traps and trading traps, check out the video given below. Keep an eye on the Price Action in 2h Chart and trade accordingly.