AXIS BANK STOCK DESCRIPTION

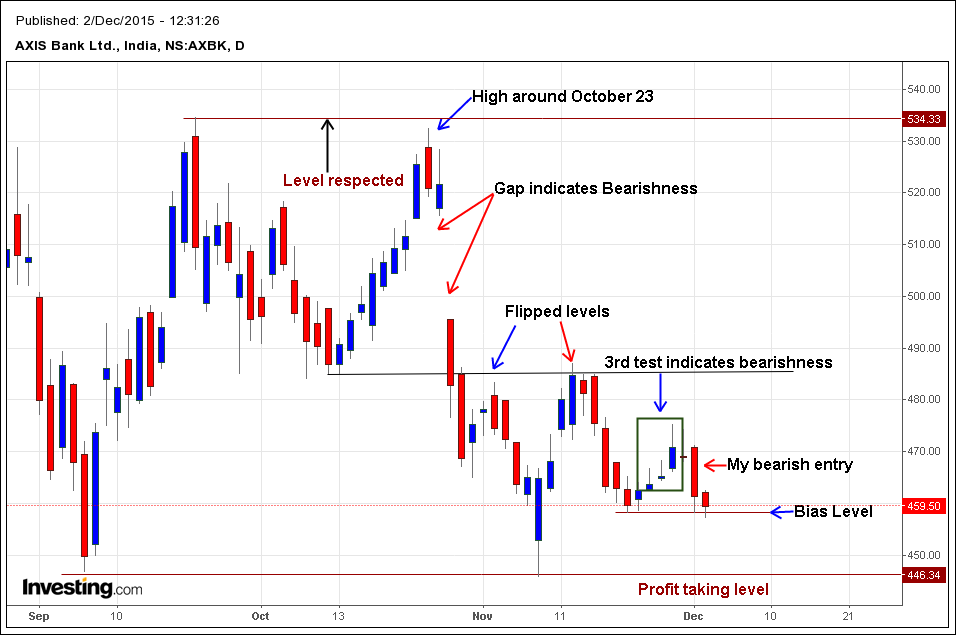

As most of my clients know – I am already short in Axis bank stock, Since October 25 2015. Price action formed a high on October 23 2015 at 530.00 which clearly shows the previous key level respected. Large Gap further convinced my Bearish bias. I took several short positions on Axis bank stock since then. During the first week of November 2015- formation of flipped levels at 485.00 further influenced my short positions. I initially closed all positions at 450.00 on November 5 2015 on a net profit basis.

At the end of November, 3rd test Pattern indicated further bearish bias in the Axis bank stock. Now I have a short scratch trade in this stock. The Entry is around 466.00. So far so good, Price action is flirting around bias level at 459.50 as of today. If Price action breaks the bias level then, I will liquidate my existing short position at 446.34. Incase, Price action doesn’t break the key level, I will cover my short positions at 459.50. Traders should watch out for Price action at 457.00. Attempting a short position at the breakout of 457.00 in the shorter time frame is a low risk trade opportunity. Take profit level is kept at 446.34.This is a short term trade.

Note: I am not an analyst or registered with SEBI. I am a trader who trade for a living. So take my views with a pinch of salt.