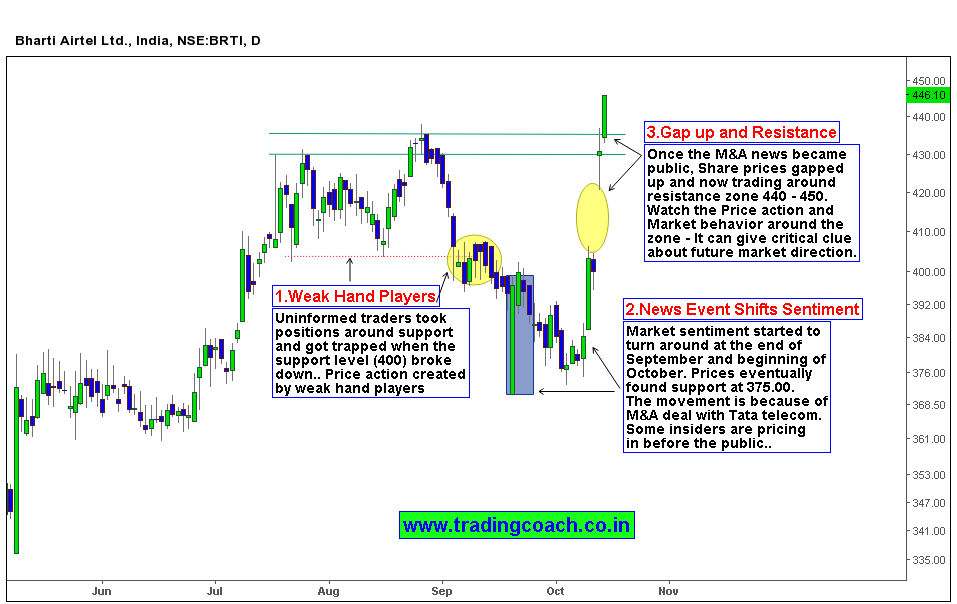

M&A actions rolling the cards in telecom sector, Shares are becoming more events driven and major restructuring by high-end corporation, Periodic mergers and acquisitions are keeping traders, investors on the edge of their trading desk. Recent merger deal between Bharti Airtel – Tata telecom could reshape India’s cellular landscape. Bharti Airtel shares Price action rallied and Volatility increased in telecom sector stocks.

So far in October, Airtel Share prices rose from 370 – 440. Market sentiment, trading bias turned around in October, Prices found eventual support at 375, rallied till 400 and then gapped up to 440. It’s obvious to notice that Market moved before and after M&A deal announcements likely because of Insiders, Institutions pricing in before the Public.

Once M&A announcement became public, share prices gapped up from 400 – 440. Now Prices are trading near potential Resistance zone at 440 – 450. Watch Price action and Market behavior around the zone, it might give an insight about market direction. Current environment and context in telecom stocks are more suitable for event-driven trading strategies. Traders should initiate positions with tight risk management and must keep an eye on Fundamental events.