I will be trading or watching these stocks in upcoming days. They can offer excellent risk – reward trading setups on both short-term traders and swing traders. These stock picks are based on Market structure Analysis and some sentiment indicators such as Market breadth, Volume Activity, Volatility etc. As usual these stocks are not investment recommendations, instead we should watch the price action. ( What is Price Action Trading? Read Here.. ) of these stocks and take directional trades. There are 4 stocks that can offer profitable opportunity in coming days

1. ITC Shares | Expect a Shake out of Weak Hand Traders

The structure of ITC is negative and prices fell from the beginning of November. Though the firm is a conglomerate, much of its revenue is obtained from FMCG, Hotels, Paperboard, Packaging, as well as Agri Business. The ongoing cash crunch will most likely hit the performance of the company and Analysts are already expecting poor Quarterly announcements. In terms of Technical Analysis, Price broke the key level 236.00, but breakout momentum declined aftermath and only weak hands are sitting net short in the stock. Expect some shakeout or False moves because of these short positions.

2. ICICI Shares | Plan the Trades within the Price Channel

With a large quantity of NPA’s in the Balance sheet and average price earnings (when compared with other banks) ICICI has under performed within the sector. Recent influx of cash deposits might increase bank’s lending potential, but remember they’re also a liability for Bank in long-term. When we look at Technicals, The stock prices are trading in a price channel formation – Uncertainty is pushing bulls and bears to fight. Right now Price is trading slightly higher than the low of Price channel. Gauge the price action and look for holding or breaking patterns. Focus on trading the price channel.

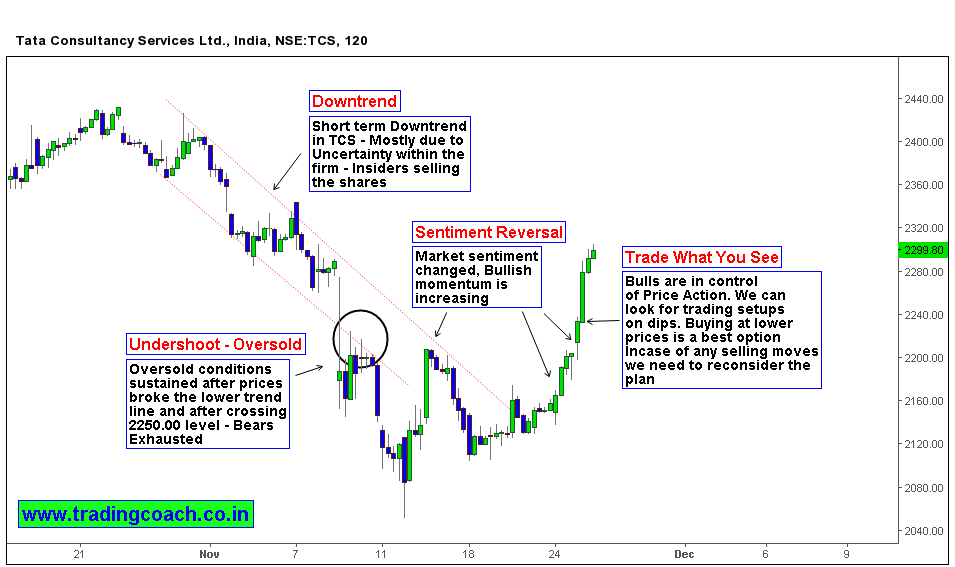

3. TCS Shares | Is it Short term trend Reversal ?

Software exporting firms having a better advantage due to fall in INR Value on International forex market. Their profits will increase if INR continues to tumble. The core mechanism is due to increased purchasing power. (Wikipedia has a good explanation on Purchasing power. Read it here) TCS stock price is reacting to these effects and it’s implications on long-term business growth or at least expectations of Long term growth. From the beginning of November, prices kept tumbling as Cyrus mistry triggered caution among stake holders. During 9th to 11th November, price action undershoot the lower trend line, an indication of oversold market conditions. Bears exhausted and market sentiment changed. Short term traders much watch this stock; it can offer potential trading opportunities.

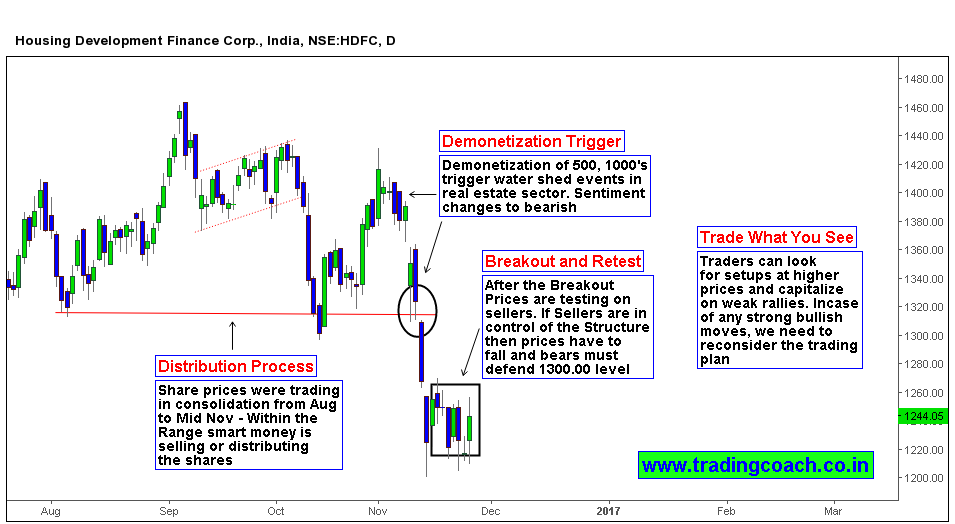

4. HDFC Shares | Market testing the Validity of Breakout

Housing development and Finance Corporation, The firm is highly exposed to real estate sector. Any consequences on housing industry will impact the stock price. As an evidence for the claim, the Stock fell sharply right after the announcement of demonetization scheme. Price broke the key level 1320.00 resulting in breakout formation. ( Some Important things you should know about Breakouts..) As per Technical analysis, the resistance for the stock is 1300.00. Sellers must defend the resistance zone to prove their dominance. Any failure to do so, can result in opposite reaction. Whatever happens, HDFC is the stock that swing traders should keep in their radar. Lookout for potential opportunities in this one.

Happy trading Folks