After the IPO Hype in the mid-2021, there aren’t many good things to say about Zomato so far..

Since from the Day it got listed and till to date, Zomato Share Prices were in a Narrow Range of 125 – 150. Price Action Violently broke from the Range just a few days back.

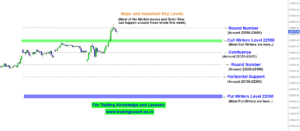

Take a Look at the Price Action Analysis on 1D Chart

Respective Support Zone is at 125 and Resistance Zone is around 150. We can clearly notice the recent breakdown from the Support on 1D Chart.

As of now, Stock Prices are trading slightly below the Listing price of 116, around 100 per share.

The Momentum of the Bearish Breakout is pretty strong. Along with that we can also witness increasing Bearish Volume on the stock.

The Round number of 100 can act like a Short term Support Zone. Incase if Price breaks the level and retests it, we can expect the Stock Prices to fall even further to the downside. Likewise a Break above 114 can push the Stock Prices higher with renewed Buying Interest.

It’s worth to keep the stock on watch list as we might see good movement both sides in upcoming weeks. Traders should keep an eye on the Price Action on 1D Chart and must take positions accordingly.