The hot & spicy talk of the trading town these days is bitcoins. As you might know, I have already written some articles on bitcoin but due to overwhelming request of many Indian investors and traders – here’s my short and sweet know–how article about Bitcoins. It specifically addresses some common questions such as whether it’s good to invest in bit coin or not? What are risks involved in Bitcoins? Are Indians allowed to invest in bitcoin? etc..

The concept of bitcoin was proposed by an unknown developer who identified himself as Satoshi Nakamoto in 2009. Nakamoto left the project in 2010 but the community grew exponentially thereafter. Bitcoin owners use various websites to trade and buy goods or exchange it with other physical currencies.The bitcoins developers should oblige to what investors want – long or short term returns to keep the value in check. It’s time to carry on a minor research and analyze whether it’s an advantage or disadvantage to Invest and trade in Bitcoins.

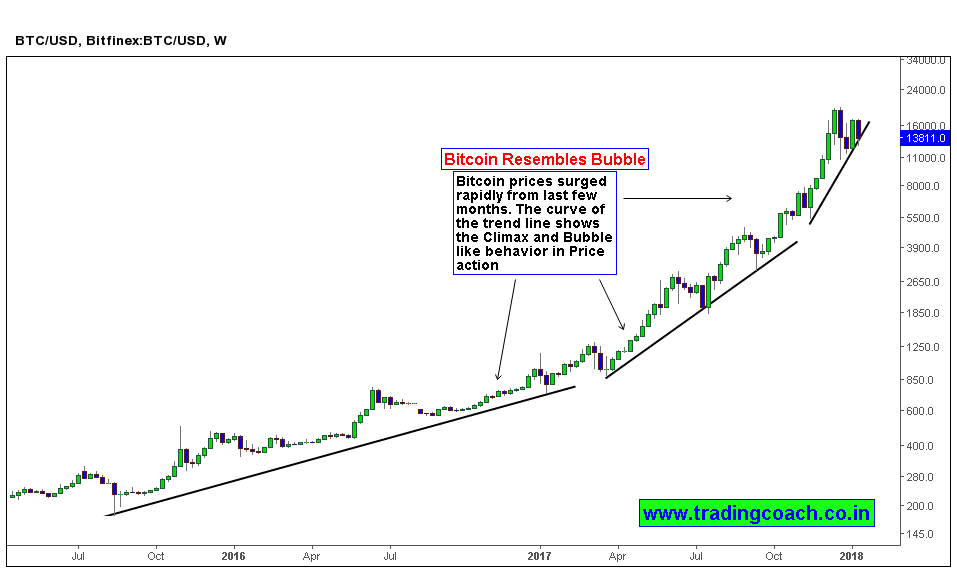

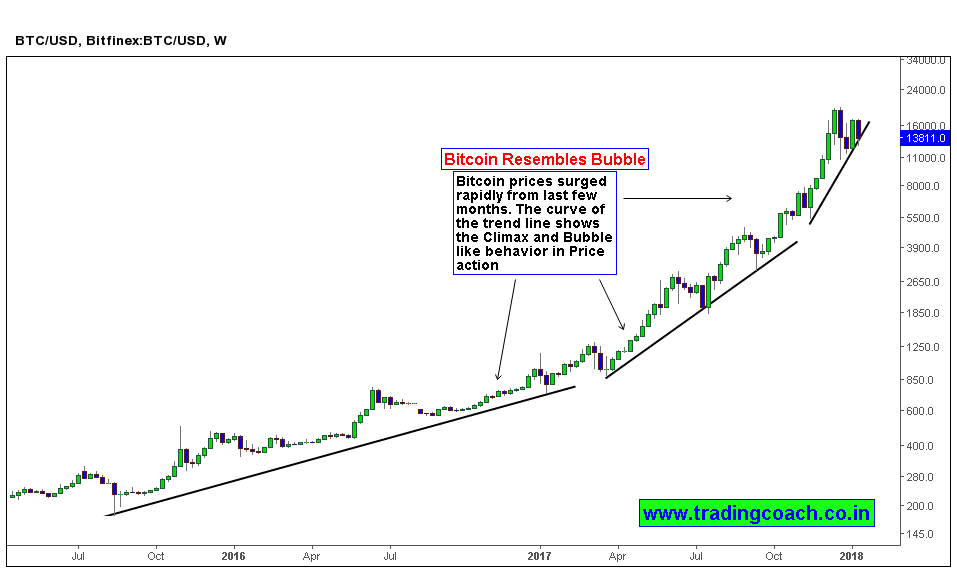

Bitcoin Price action Analysis on Weekly chart

What is Bitcoin?

As a digital currency exchanged entirely over the internet, Bitcoins are categorized under the vision of crypto currency. Most of these currencies are decentralized. All information on its transactions, creation, and validation of authentic exchange are secured through cryptography or crypto codes.

Bitcoins – Boon or Curse for Indian Investors?

Investors are rapidly growing till-date in a temptation to make quick investment returns in a shorter time span with bitcoin. But the prices have fluctuated widely in past few weeks. The Central Bank has now issued a warning against investments in cryptocurrencies. Cryptocurrency is not legalized by Reserve Bank of India (RBI) or any other agency. As the prices fell by 30% in recent weeks following are the reasons that investors should consider:

1) Volatility and Other issues:

High-risk factor.

No fundamental analysis can be done.

Imperfect information in many scenarios.

Widespread losses are inevitable if value drops.

Will be used for Illegal and non-treatable activities

2) Not a Currency as widely propagated:

Not backed by any Commodity or Asset

Not controlled by any government or Institutions

Risky for businesses, industry, and people to trade or invest in, as no one is regulating the transactions

3) Invest by considering important factors:

A bubble which can burst anytime.

A warning has been issued to investors against investing in Crypto currencies by some global bankers and regulatory bodies.

If you can’t understand how the cryptocurrencies work don’t invest in it.

4) There are Safety and Transaction risks:

No authority like SEBI to approach for grievance redressal.

Not governed by government entities or financial bodies, unlike stocks, bonds etc.

In case of fraudulent bitcoin transaction, it is impossible to get the money back.

5) It is Not yet legalized:

One major hurdle is the confusion over its legal status.

Not recognized by Reserve bank of India or Indian authorities.

Investors should invest at their own risk.

Last but not the least, it is better to see the present circumstances and Investment environment yourself before investing in bit coins. The bitcoins bubble is waiting to burst anytime soon, it has lot of ways to make investors money vanish. For traders it’s still risky as the transactions are not regulated as most of these cryptocurrencies are traded with non regulated intermediaries. The block chain technology can radically change the global economy but Bitcoins are just one of the Cryptocurrencies using the block chain technology to some extent, so don’t get blinded if someone says bitcoin is the future – It’s not, Block chain is the future.