As a Trader, I am not a big fan of predicting the markets or playing against the laws of probability. My work is to find good trades, find ideal type of trades that has excellent risk: reward ratio and find it consistently over long run. But every year when December approaches, a common question arises in all traders mind – How next trading year would look like? So it’s necessary to have an outlook map about the markets to keep us prepared for the coming year. Here are my expectations based on Macro and Price action perspective.

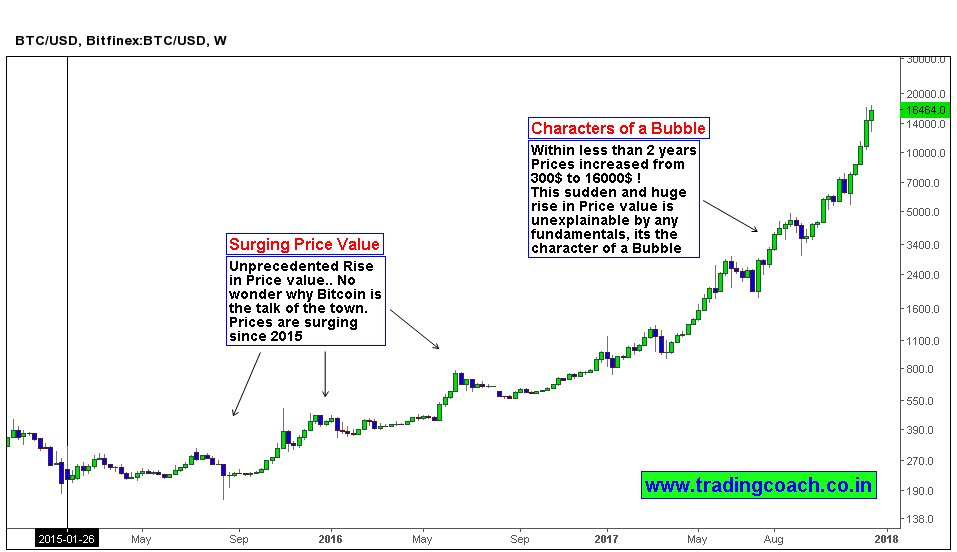

Bit coin Bubble Intensifies in 2018

With Bit coin mania now taking over the main stream, it continues to pull investments from average mom-pop investors and get rich quick adventurers. This reminds me of the same scenario we saw in gold during 2009 – 2011. Even the so-called Bit coin experts are using the same logic to predict irrational prices like 500,000$ a coin valuation. As per these experts, Bit coin is the digital gold of the future and will take up same market capitalization as gold. This caught my attention and ultimately Robert shiller’s book Irrational Exuberance came to my mind.

In precise sentences, Bit coin clearly seems to fit the description of an Asset bubble – Upward price movement over an extended period of fifteen to forty months (which cannot be explained in terms of fundamentals) and then explodes drastically. When an instrument receives excessive public attention along with prices making stellar highs, we may get a temporary correction to offset that market imbalance. If you’re an Investor or a trader in Bit coin and crypto currencies, it’s better to reduce some exposure from the overvalued instruments. 2018 would be interesting year to see how this Bit coin bubble unfolds whether it would burst or further makes new highs!

Changing Fundamentals of Crude Oil might change the Market sentiment in 2018

So far Bears are driving the narrative in Crude oil from last 3 years. As we progress into 2018, Bears might find it hard to maintain that status quo. What’s the Primary reason? Fundamentals are changing slowly and swiftly! First of all market is overstating the Oil’s supply growth and underestimating OPEC’s decision to extend their output agreement to keep the production steady till end of 2018.

Another interesting fact is Shale productivity growth is slowing at an alarming rate whereas Global oil Demand is increasing and global economic growth is picking up. As an indication of these fundamental changes, Crude Oil prices are trending higher since June 2017. By looking at these factors it seems likely that market sentiment might shift in Crude oil. We are already witnessing an intermediate uptrend in Crude oil daily chart. Market action will be interesting to watch in coming year.

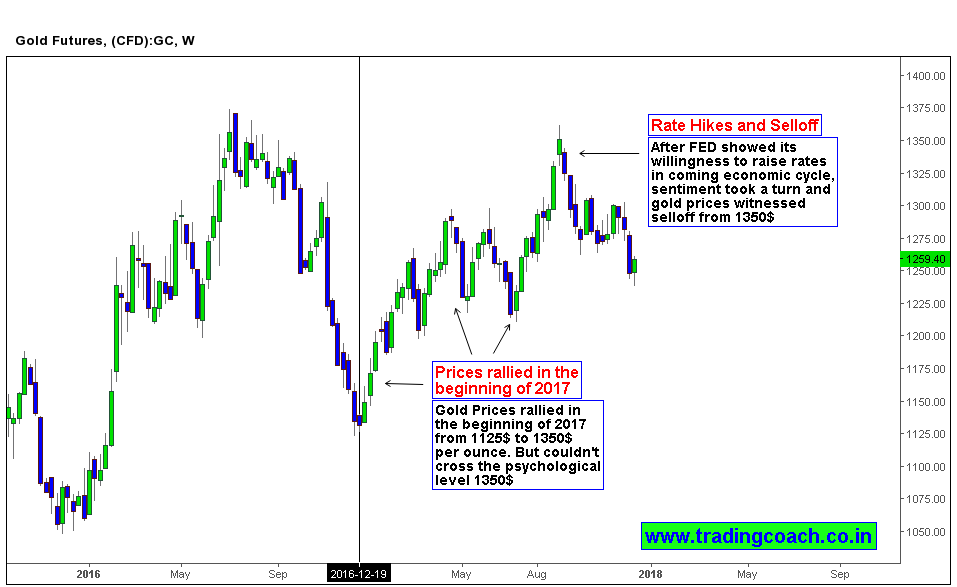

2018 will be a Tough year for Gold Prices

Gold investors might not see a sustained rally for 2018 as there are many reasons why they can’t! With Market participants still demanding Stocks, Bit coin and other alternative investments, many are not paying attention to precious metals, if the same narrative continues Gold Prices might have a tough time in 2018. Not only that, Gold is far from being out of the clutch of 20 year Long term Bear market cycle!

But didn’t we witness some short-term uptrend and rally on gold in the beginning of 2017? Yes we did, because in long-term secular bear market you do get multiple rallies as Price bounces back and forth, that’s how long-term bear market cycles work in Commodities. Apart from that, rising interest rates also pose a big obstacle for Gold to shine in 2018. When we look at markets from Historical perspective, rising interest rates increases the dollar value which technically is negative for Gold prices. Given all these facts, Gold seems to face a tough year ahead.