Throughout history markets have been volatile for various reasons. When the markets are too volatile it creates fear and uncertainty among the investors, which can cause sharp swings in stock prices. Volatility in the recent days is quite high compared to historical basis because of 3 major factors:

1. Trade Wars – Reason for Increasing Global Stock Market Volatility:

Trade wars began when United States President, Donald Trump decided to impose trade tariffs on Chinese goods. As per the news reports, the two countries had on-going talks on coming to agreement on a trade deal. But as the deal failed to take place the two countries went back and forth introducing tariffs on considerable amount of goods on both sides. Even though the two Presidents agreed to a truce at G20 summit taken place at Osaka. On August 1, 2019 US reignited the trade war by introducing additional tariffs on remaining Chinese goods which sent the markets into frenzy.

2. Economic Slowdown in India:

The news of economic slowdown has been rounding itself ever since the beginning of the year. Economic slowdown has been majorly caused by the various government policies which have disrupted the economic growth altogether. Slowdown has affected India’s growth in multiple ways:

a. The rollout of Goods and Service Tax (GST) has caused inconvenience for small businesses who were asked to hold onto their inventories until they switch to GSTN (GST Network) and adhere to rules and regulations under this taxation.

b. Many public sector banks have a high amount of Non-performing assets (NPAs) which has made banks tighten their norms of lending and seek for deposits so that they can create provisions for bad loans.

c. India’s NBFC (Non- Banking Finance companies) crisis and a number of defaults caused by some firms have triggered an alarm among investors. NBFCs play a very crucial role in the economy and due to the current defaults; they will find it particularly difficult to raise money which will affect flow of credit in the economy.

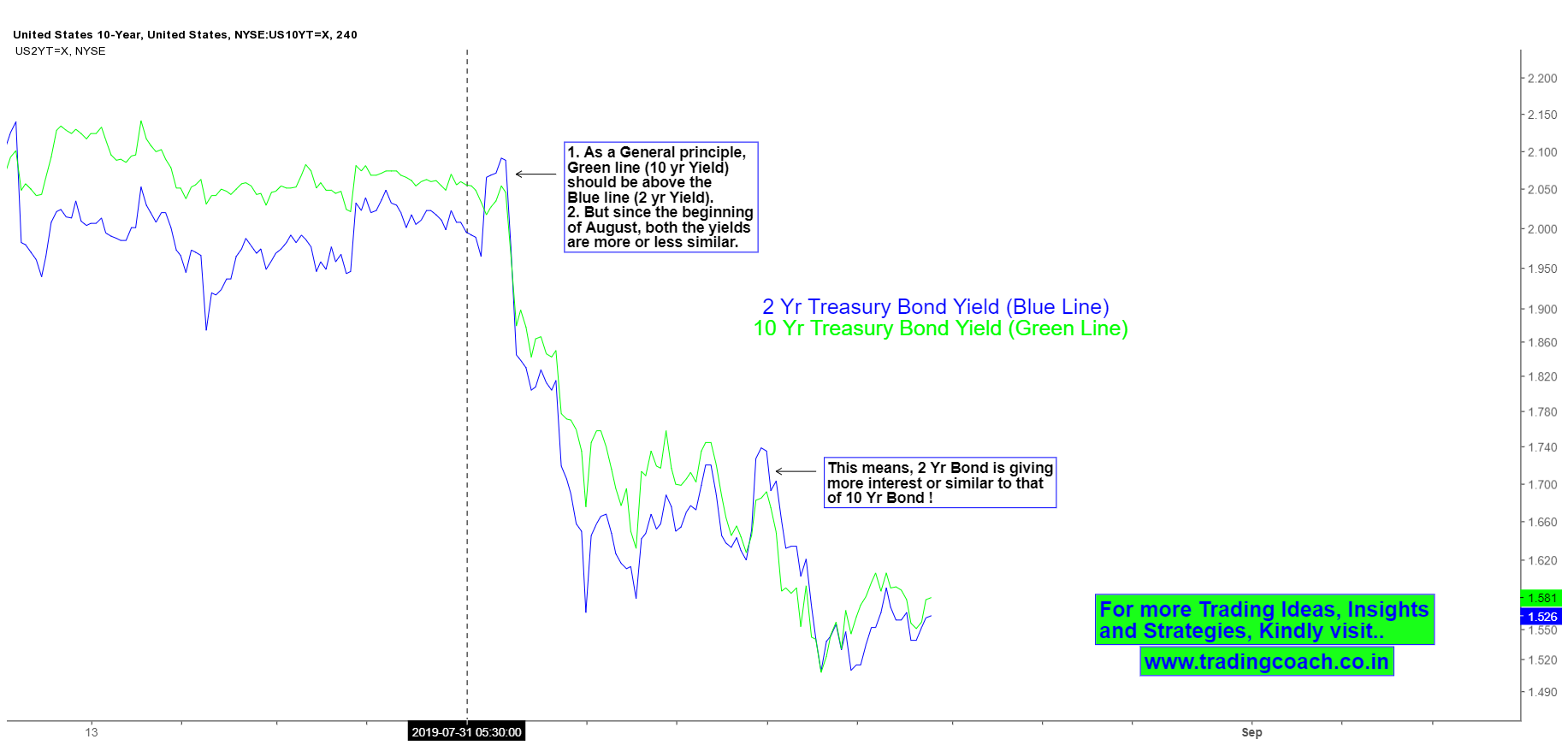

3. Inverted Yield Curve:

Inverted yield curve is a scenario where short term U.S. treasury bonds give higher yields than the long term ones. As per the above image, on Wednesday, August 14, 2019, 10-year Treasury bond yield fell below the 2-year Treasury bond which caused a global sell off across the markets. As per the above image, you can see that US 10-year yield is lower than the US 2-year yield by certain points. On a Historical basis, Inverted yield curve correlated with sluggish stock market movement and sometimes even market crashes. This Indication has caused most of the financial institutions and Investors to liquidate their holdings from stock market.

So these are the 3 Major reasons for the recent volatility we experience in the Stock Market.

Learn to Utilize the Stock Market Volatility as an Opportunity:

High levels of volatility can lead to downtrend in share prices. It can affect the portfolios of various market participants and big players. Due to volatile markets various high scale investors try to make changes in their portfolios to reduce the impact. With economic slowdown and recession fears across the globe, History has always witnessed slowdown in growth, currency crash or political crisis leading to volatile markets followed by excellent trading and investing opportunities. Instead of following the herd, prudent traders and Investors must use Volatility as an opportunity.

For Traders, Just like pullbacks in a rising market and uptrend, certain pullbacks on a downtrend created by market volatility will provide opportunity to take High probability short trades. For Investors, volatility can provide cheap valuations and reasonable prices to accumulate stocks for the long-term. Smart traders and Investors should learn to use volatility as an Opportunity.