Market movements can create a bewildering number of patterns and variations of patterns. Simple structures take on different meanings depending on context, and patterns sometimes develop and resolve in unexpected ways. Let us turn our attention to a simple, robust framework that focuses on the fundamental trend trading pattern created by price action. New to Price action trading? Read about it here

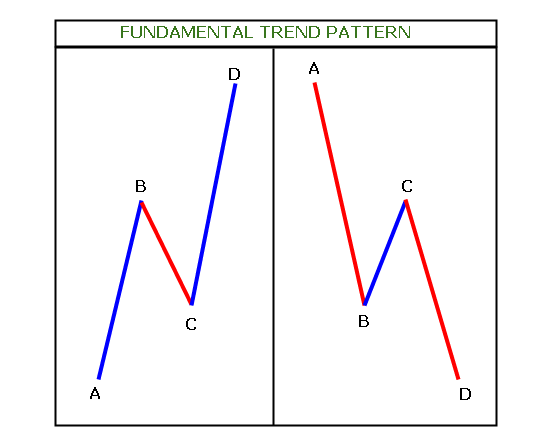

This simple, fundamental trend pattern is found at the core of even elaborate methodologies, like Gann or Elliott, because very simply, it’s how the markets move, and it is a foundation concept. The fundamental trend trading pattern of market movements on all time frames is nothing but a movement in one direction, a counter-trend retracement in the other direction, and another leg in the original direction. This is a powerful pattern that repeats on all time frames. Whether we look at trends spanning decades or seconds, we will find this same impulse, retracement, impulse structure, though the psychological significance of the pattern will vary depending on the time frame.

Logic Behind This Trend Trading Pattern

It is also reasonable to ask why this structure should exist at all, and there are several possible answers. Put yourself in the shoes of a trader who has to buy a significant amount of an asset in a very short time. Your primary objective is to get the order done without having a large impact on prices. How might this best be done?

The best option in most cases is to buy a little bit, wait so that you don’t move the market too much, then buy some more, and repeat until the order is completely filled. This is how good execution traders work large orders. Smart traders (or smart algorithms) will judge how to plan their buying by the market’s response to their orders. This way, they are judging the supply or the selling conviction hanging over the market. A single trader executing an order in a market otherwise composed of pure noise traders would create some variation of this price pattern by trying to fill a buy order through this natural process.

There must be a firm theoretical foundation for anything in the market; you should be able to clearly articulate why something should be the way it is. Market prices are the result of buyers and sellers negotiating for prices, nothing more and nothing less. They are simply the result of buyers and sellers finding prices in a competitive environment. This is also why the fundamental trend trading pattern in the markets have not changed since long time.